52 Week How To Save $50000 In A Year Chart

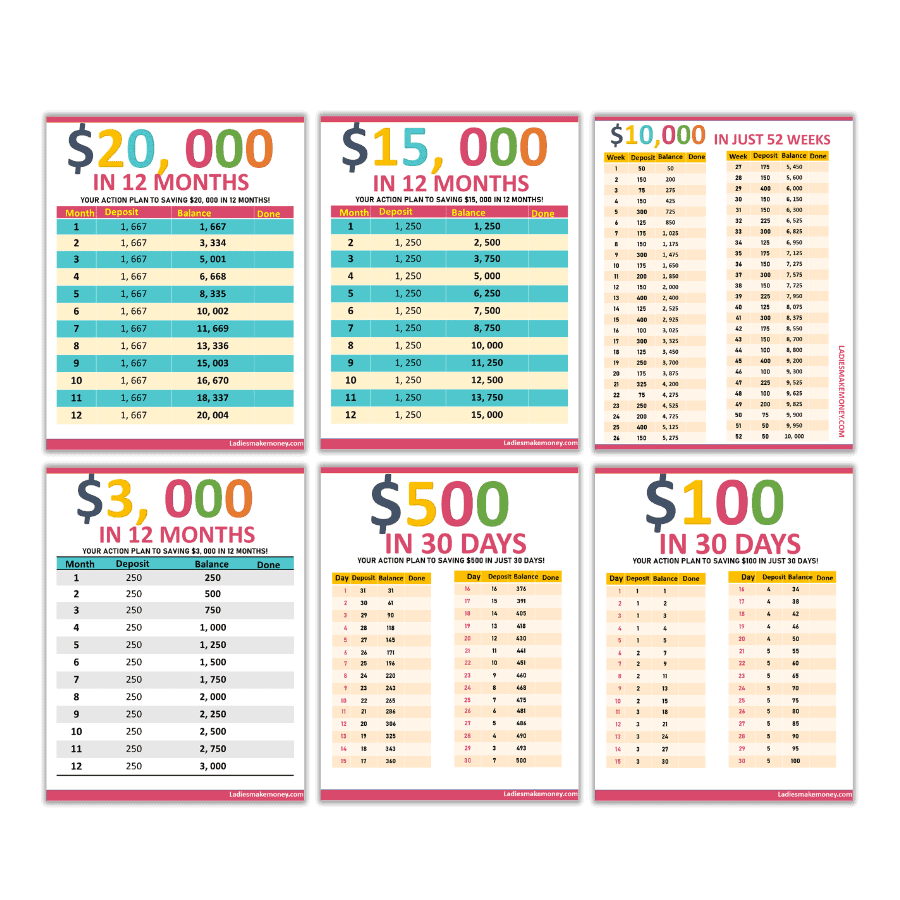

52 Week How To Save $50000 In A Year Chart - Web 52 week money challenge printable chart. Web how to save $50,000 in 1 year. This may be more feasible for some than others, but if possible, trade in your car for public transportation, a bike or your own two feet. How much will 50,000 dollars be worth? How to save $3,000 with savings charts. At the end of the year, all of the boxes will be filled and you will have saved $1,000. There are a lot of things you could do with $5,000. First, you need to decide the timeframe in which you want to save the $3,000. Web the point, either way, is that a $50,000 retirement income is attainable if you start saving early in your career and you invest your money to capitalize on compound growth. How to save $20k with money saving charts. By week 52, you’ll set aside $52.00, which will bring the year’s total savings to $1,378! To reach your goal of saving $50k in 1 year, you’ll need a monthly deposit of $4,166.67. If so, the charts i’ve created below can help you achieve your goal! Web 52 week money challenge printable chart. Keep in mind that the last deposit. In any case, the target to reach is $1,378. Web 52 week money challenge printable chart. Start by saving $1 in the first week, and then gradually increase your savings by $1. How much will 50,000 dollars be worth? Web in the graph below, vail illustrates how a couple — or an individual — who saves $50,000 by age 25. I’ve put together charts for saving up $20k in as little as 6 months. Web $50,000 ÷ 26 = $1,923 (approximately) so, mathematically, you will need to save approximately $1,923 from each biweekly paycheck to reach your goal of $50,000 in a year. Web 52 week money challenge printable chart. Are you wanting to save $3,000? By moving to a. There are also savings charts that will help you reach your goal in 1, 2, 3, 4, 5, or 10 years. But even more important, you may. Start by saving $1 in the first week, and then gradually increase your savings by $1. Use this calculator to see how regular savings can add up over the years. I’ve put together. Week 1, you save $1.00. Keep in mind that these calculations assume a consistent savings rate without any interest or investment returns. This may be more feasible for some than others, but if possible, trade in your car for public transportation, a bike or your own two feet. Is your required monthly deposit to. First, you need to decide the. I’ve put together charts for saving up $20k in as little as 6 months. During week one, put $1 in an online savings account. How could this calculator be better? I’ve put together charts for saving up $20k in as little as 6 months. You can save well over $1,000 before the end of the year. To reach your goal of saving $50k in 1 year, you’ll need a monthly deposit of $4,166.67. If you save $50,000 every year, what will it be worth? Get a widget for this calculator. Use the form below to customize your weekly savings chart for any date range. How much will an investment of 50,000 dollars invested every year be. Week 1, you save $1.00. Web our saving goal calculator will help you plan and reach your savings goals. Web 52 week money challenge printable chart. Week 2 you save $2.00, and it continues through the year, adding one more dollar to each week’s savings goal. I have created charts from 1 month to 1 year that you can choose. Paste this link in email, text or social media. Input your savings goal amount and current savings to determine how much to contribute every month. Would you use it to pay bills, buy a used vehicle, take a vacation, invest for your retirement or maybe save for a mortgage down payment? This does not include interest or investment gains. How. This is one of the easiest charts to follow because you start with $1 the first week and add an extra dollar each week. How much will 50,000 dollars be worth? Web our saving goal calculator will help you plan and reach your savings goals. During week one, put $1 in an online savings account. For example, in week one,. There are also savings charts that will help you reach your goal in 1, 2, 3, 4, 5, or 10 years. Everyone can benefit from saving some extra money, whether it’s for an emergency fund or a fancy vacation. At the end of the year, all of the boxes will be filled and you will have saved $1,000. By week 52, you’ll set aside $52.00, which will bring the year’s total savings to $1,378! Web $50,000 ÷ 26 = $1,923 (approximately) so, mathematically, you will need to save approximately $1,923 from each biweekly paycheck to reach your goal of $50,000 in a year. First, you need to decide the timeframe in which you want to save the $3,000. Web increase the amount saved by $1 each week for 52 weeks — a full year. Web our saving goal calculator will help you plan and reach your savings goals. If you save $50,000 every year, what will it be worth? Web what is the 52 week money challenge? I’ve put together charts for saving up $20k in as little as 6 months. Paste this link in email, text or social media. To reach your goal of saving $50k in 1 year, you’ll need a monthly deposit of $4,166.67. By moving to a place within walking distance. If you need to save up $20,000 fast, these charts are for you. Use the form below to customize your weekly savings chart for any date range.

52 Week Money Challenge Blank Printable

52 Week Money Challenge Chart Reverse

50k in 52 Weeks Savings Tracker Printable File Save 50000 in Etsy

The 52Week Money Saving Challenge

Printable 52 Week Money Challenge 20000

52 Week Savings Challenge Savings Tracker 10k Savings Etsy Saving

(JD) 52 Week High at 65.1205 & Low at 24.38

Pin on Money Challenges

52 Week Savings Challenge Etsy 52 week savings challenge, Savings

50K SAVINGS CHALLENGE in 1 Year Money Saving Challenge Etsy

You Can Save Well Over $1,000 Before The End Of The Year.

During Week One, Put $1 In An Online Savings Account.

This May Be More Feasible For Some Than Others, But If Possible, Trade In Your Car For Public Transportation, A Bike Or Your Own Two Feet.

Use This Calculator To See How Regular Savings Can Add Up Over The Years.

Related Post: