Bearish Chart Patterns

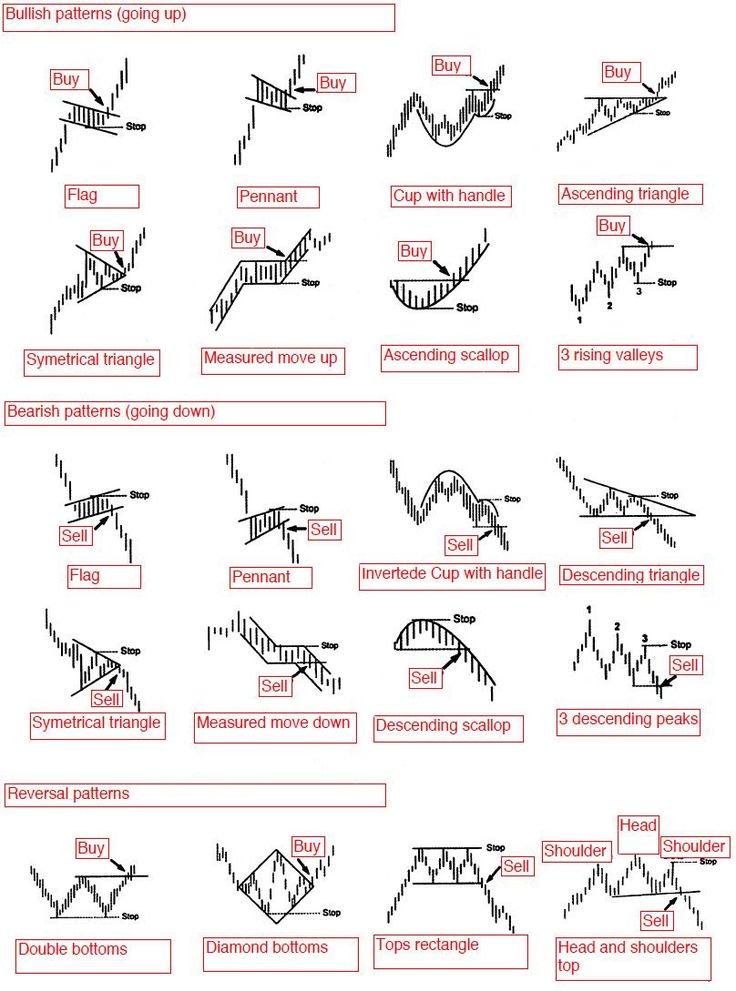

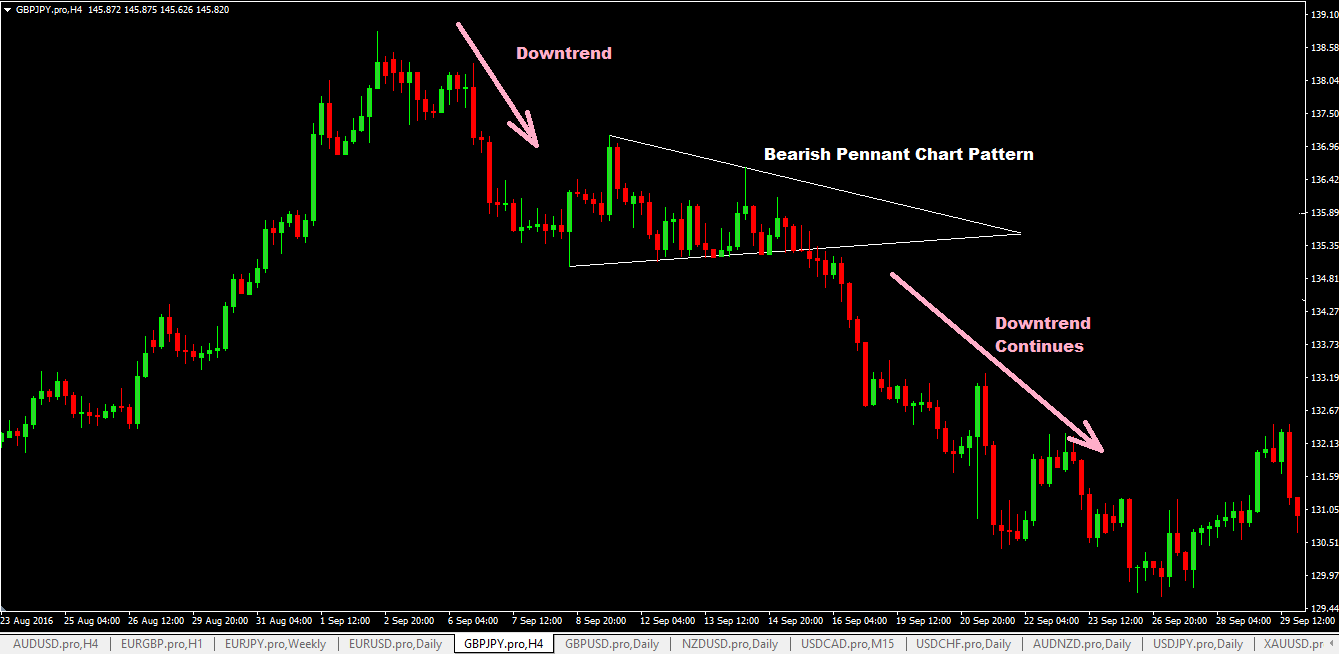

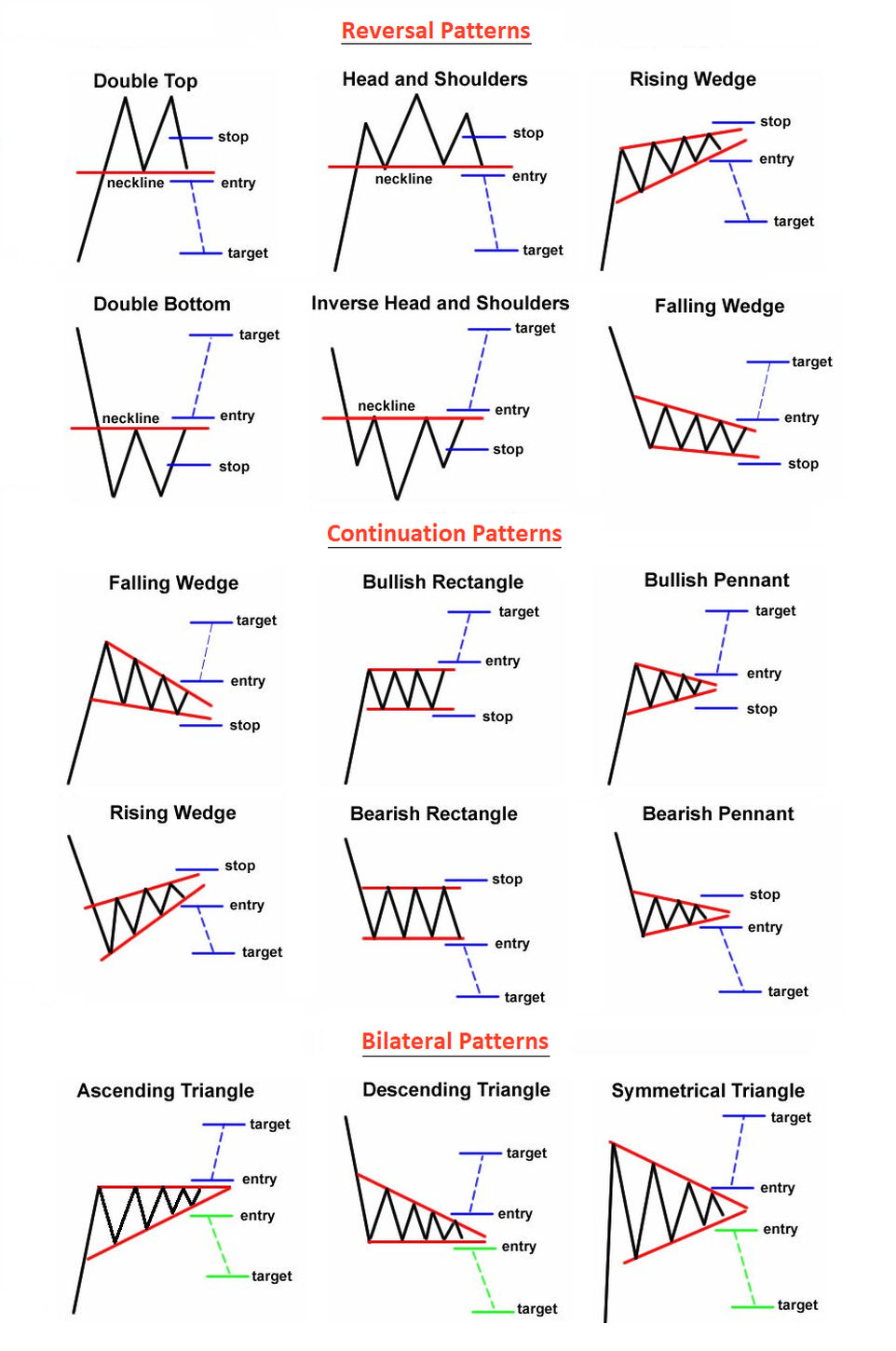

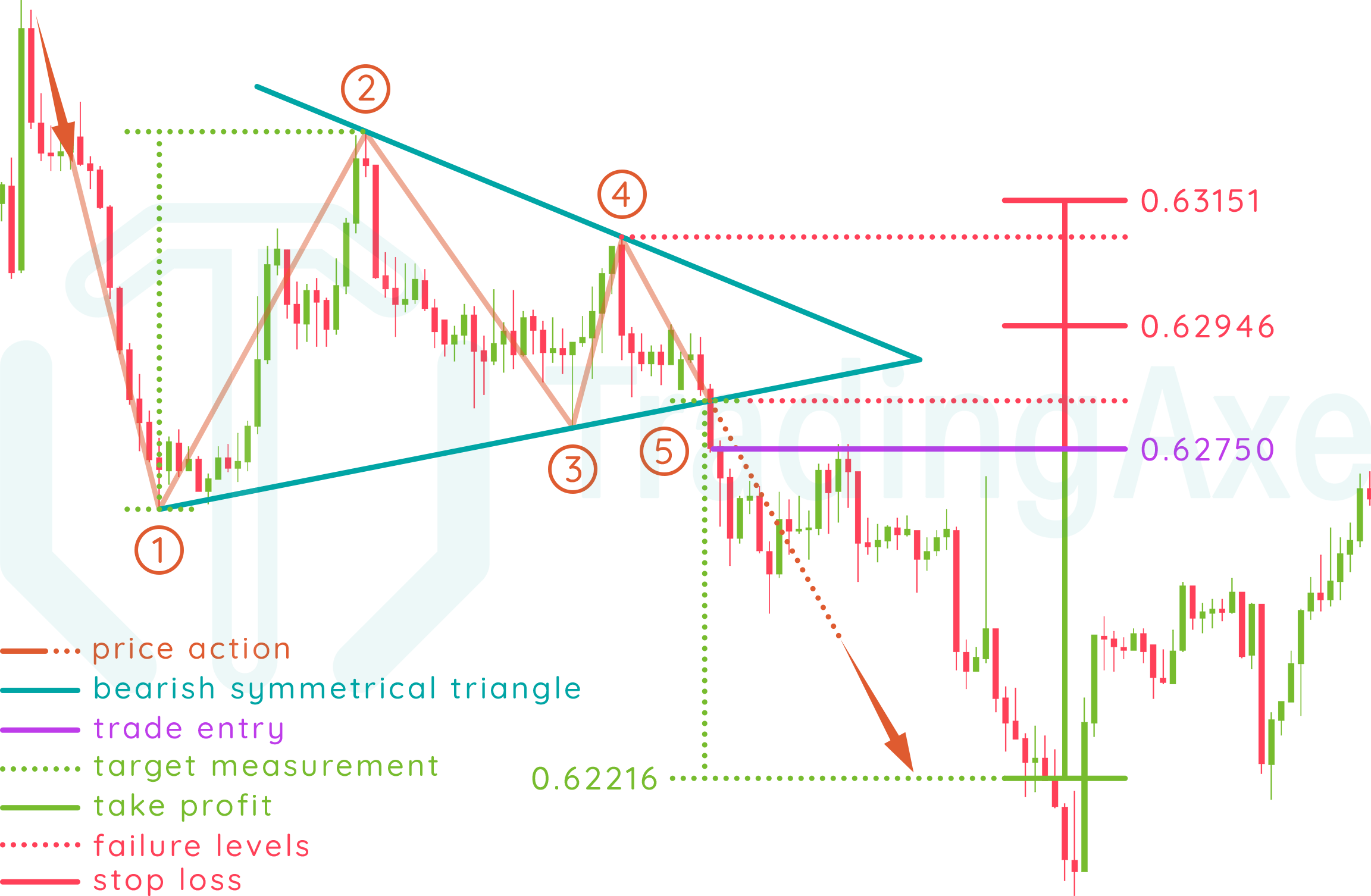

Bearish Chart Patterns - Web result there are many stock chart patterns to behold, but one that appears from time to time is an “h” pattern. The horizontal support line formed at the bottom of the rectangle shows that the investors are repeatedly buying shares at that specific price level. Web result there are dozens of popular bearish chart patterns. And whether you are a beginner or advanced trader, you clearly want to have a pdf to get a view of all the chart patterns you want and need to use. Web result now we get to the really scary option, where this week's upswing ends up being a blowoff rally, and stocks flip from bullish to bearish with a sudden and surprising strength. Here is list of the classic ones: Web result a bearish reversal candlestick pattern is a sequence of price actions or a pattern, that signals a potential change from uptrend to downtrend. Web result a bearish candlestick pattern is a visual representation of price movement on a trading chart that suggests a potential downward trend or price decline in an asset. Here is a brief overview of each of them. Web result the bearish flag pattern is a powerful technical analysis tool used by traders to identify potential bearish trends in the foreign exchange (forex) and gold markets. The bearish rectangle pattern shows a consolidation period, neither buyers nor sellers are in control. The chart setups based on fibonacci ratios are very popular as well: Web result there are many stock chart patterns to behold, but one that appears from time to time is an “h” pattern. And whether you are a beginner or advanced trader, you clearly. Web result bearish candlestick patterns are either a single or combination of candlesticks that usually point to lower price movements in a stock. The chart setups based on fibonacci ratios are very popular as well: Web result a bearish pennant is a pattern that indicates a downward trend in prices. Comprising two consecutive candles, the pattern features a. Web result. In this blog, we will be discussing 5 powerful bearish candlestick patterns: Web result now we get to the really scary option, where this week's upswing ends up being a blowoff rally, and stocks flip from bullish to bearish with a sudden and surprising strength. After the bearish trend, the first low stopped at a known. These are some of. Web result bearish chart patterns. Web result a double top is a bearish indicator. Many of these are reversal patterns. Web result the most profitable chart pattern is the bullish rectangle top, with a 51% average profit. Web result a bearish reversal candlestick pattern is a sequence of price actions or a pattern, that signals a potential change from uptrend. Web result the most profitable chart pattern is the bullish rectangle top, with a 51% average profit. Analysts generally believe that a double top means that a rising stock is running out of steam. This setup can occur in the form of a bearish divergence rsi signal or a bearish divergence macd signal. Web result as shown from the chart,. 10 bullish chart patterns for traders. Web result for example, chart patterns can be bullish or bearish or indicate a trend reversal, continuation, or ranging mode. Web result bearish chart patterns. These are some of the most common bearish chart patterns you will see in the market. Discover the winning patterns that take stock traders to new heights! Understanding the psychology of trading. The bearish rectangle pattern shows a consolidation period, neither buyers nor sellers are in control. Web result among the various chart patterns, the top 4 bearish chart patterns you must know about are. After the bearish trend, the first low stopped at a known. Web result a bearish pennant is a pattern that indicates a. These are some of the most common bearish chart patterns you will see in the market. Web result the bearish flag is a candlestick chart pattern that signals the extension of the downtrend once the temporary pause is finished. The chart setups based on fibonacci ratios are very popular as well: Here is list of the classic ones: The wedge. Web result bearish chart patterns cheat sheet. Web result there are many stock chart patterns to behold, but one that appears from time to time is an “h” pattern. Web result the bearish flag pattern is a powerful technical analysis tool used by traders to identify potential bearish trends in the foreign exchange (forex) and gold markets. The chart setups. The bearish rectangle pattern shows a consolidation period, neither buyers nor sellers are in control. — head and shoulders pattern. The chart setups based on fibonacci ratios are very popular as well: Web result a bearish reversal candlestick pattern is a sequence of price actions or a pattern, that signals a potential change from uptrend to downtrend. Web result bearish. Web result a price chart showing bearish divergence is characterized by the formation of progressively higher highs by the price candles in the presence of progressively lower peaks formed by the oscillator’s signal line. Web result now we get to the really scary option, where this week's upswing ends up being a blowoff rally, and stocks flip from bullish to bearish with a sudden and surprising strength. Bullish chart patterns signal future price increases, but not all patterns are accurate or profitable. In this blog, we will be discussing 5 powerful bearish candlestick patterns: Again this suggests we are in the early stages. Web result as shown from the chart, the second part of the diamond top formation extends from the broadening formation in the shape of converging lines. A bearish rectangle pattern forms when the price consolidates in a range and tries to break down from the support. Web result the most profitable chart pattern is the bullish rectangle top, with a 51% average profit. Stock charts are usually expressed as line charts, bar charts or candlestick charts. They typically tell us an exhaustion story — where bulls are giving up and bears are taking over. This setup can occur in the form of a bearish divergence rsi signal or a bearish divergence macd signal. Web result the 2020 bitcoin chart and what could happen with the 2024 halvening. After the bearish trend, the first low stopped at a known. Head and shoulders pattern is a bearish pattern that indicates a trend reversal from a bullish bias to. Discover powerful bearish chart patterns backed by meticulously. Here is list of the classic ones:

Bearish Trend Patterns Stock trading strategies, Forex trading

Are Chart Patterns Reliable? Tackle Trading

Bullish & Bearish Patterns in Technical Analysis Crypto Radio

Chart Patterns

Bearish Reversal Patterns in 2021 Online stock trading, Trading

Bearish Pennant Chart Pattern Forex Trading Strategy

Chart Patterns B.P. Rising B.P. RISING

Bearish Reversal Candlestick Patterns The Forex Geek

How To Trade Bearish Symmetrical Triangle Chart Pattern TradingAxe

Top 3 Bearish Chart Patterns New Traders Should Understand Warrior

Analysts Generally Believe That A Double Top Means That A Rising Stock Is Running Out Of Steam.

Web Result What Are Bearish Candlestick Patterns?

Web Result Bearish Chart Patterns.

Web Result Here’s Our List Of 10 Popular And Reliable Stock Chart Patterns Used In Technical Analysis:

Related Post: