Chart Of Accounts For Nonprofit

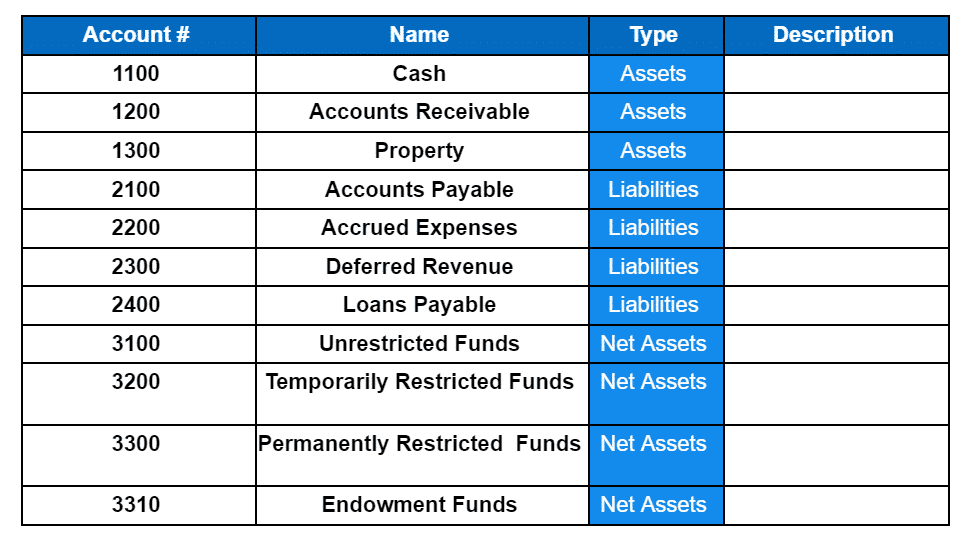

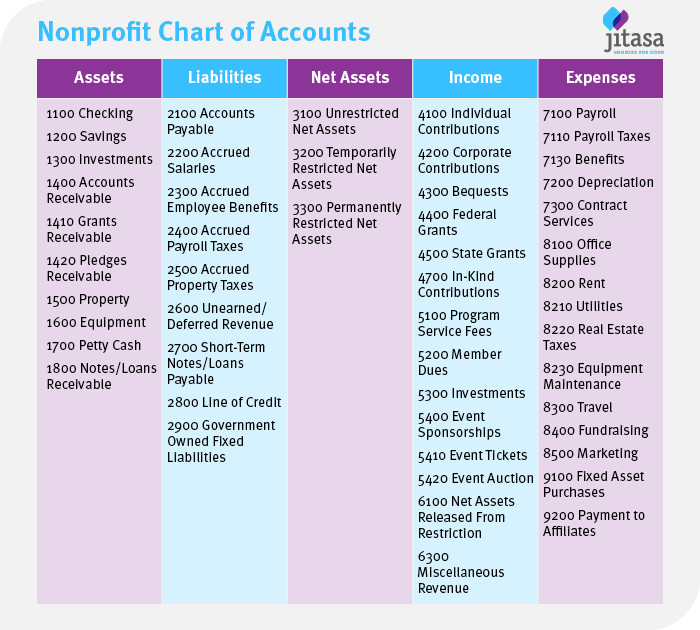

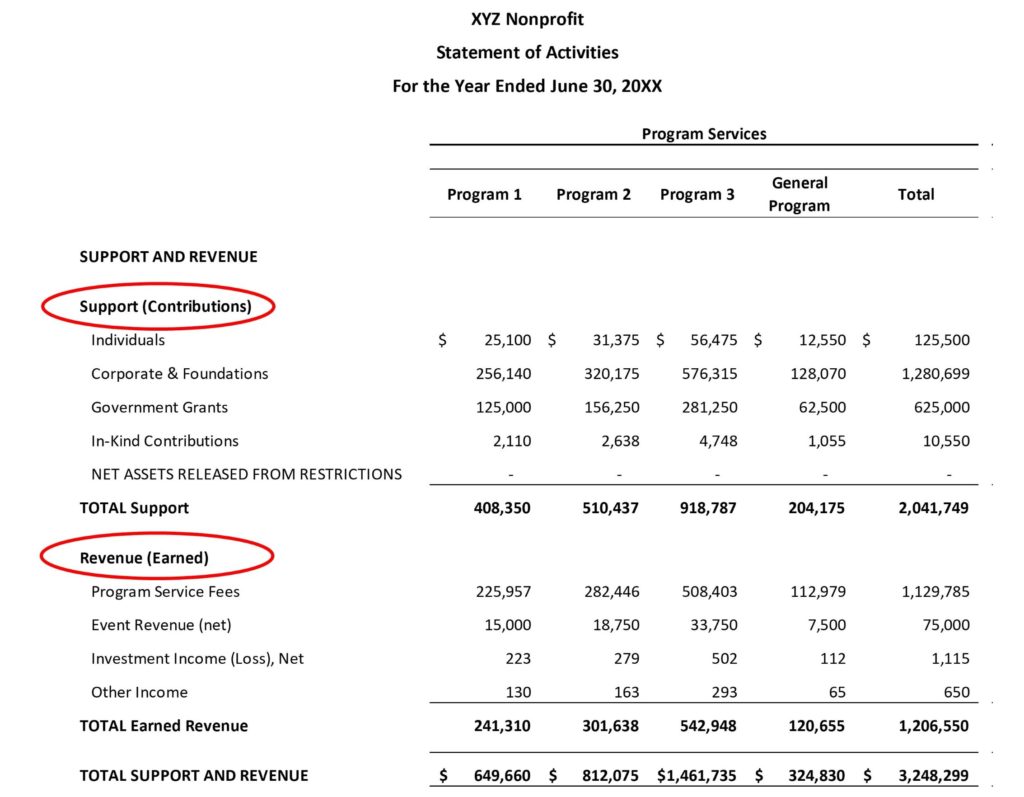

Chart Of Accounts For Nonprofit - Web get started implementing a chart of accounts. To successfully implement a coa, key steps include identifying accounts, creating a numbering system, and establishing hierarchy. It’s a series of line items, or accounts, that allows you to organize your accounting data. These line items pertain to your financial position (or statement of financial position) and to your financial activities (or statement of activities). But the first two, number and name, determine the overall structure and organization of accounts and subaccounts. You create this list to meet your organization’s unique needs. Web a nonprofit chart of accounts (coa) is a guide that helps nonprofits classify and track expenses and revenue. Web a chart of accounts is a detailed listing of minor categories under the major categories of assets, liabilities, net assets, revenues, and expenses. A coa categorizes an expense or revenue as either “revenue” or “expense.” it is a financial document used by organizations with 501(c)(3) status to account for the money they receive and spend. A chart of accounts is a systematic way to organize and track financial transactions using different “accounts”. Web the chart of accounts (or coa) is a numbered list that categorizes your financial activity into different accounts and subaccounts. The chart of accounts for your organization lists all of your accounts. This guide and example for constructing a nonprofit chart of accounts was compiled by jitasa on august 11, 2021. Web a chart of accounts (coa) is a. It serves as the backbone for financial transactions and provides an organized structure to track income, expenses, assets, and liabilities. Examples of a nonprofit chart of accounts. Number, name, category type, and a short description. The coa is a categorized collection of accounts where you have bookkeeping entries, including assets, liabilities, income and expenses. Manage your giving, accounting, budgeting, and. The chart of accounts for your organization lists all of your accounts. Web [easily explained] watch on. Instead, it breaks these accounts into categories like assets, liabilities, income, expenses, and equity. “nonprofits view their accounting processes through an accountability lens rather than one based solely on profitability and revenue generation…. Examples of a nonprofit chart of accounts. Your organization will only have one chart of accounts, so make sure to create one that makes sense for your operations. You create this list to meet your organization’s unique needs. Web a chart of accounts is the foundation of a solid nonprofit group. It organizes all of the accounts and ledgers your organization uses into a list format, helping. The stronger the foundation, the stronger the building — the same holds true for the chart of accounts. It’s part of your accounting architecture. I am new to qb and have a question about the chart of accounts. Web establishing a nonprofit chart of accounts. Chart of accounts nonprofit reporting simplifying financial reports organizing expenses grant management. Web the nonprofit chart of accounts is a list of all accounts used in the general ledger. Your organization will only have one chart of accounts, so make sure to create one that makes sense for your operations. Think of the chart of accounts as the foundation for a building you are about to construct. Web the nonprofit chart of. Web nonprofit chart of accounts: This guide and example for constructing a nonprofit chart of accounts was compiled by jitasa on august 11, 2021. Web the chart of accounts (or coa) is a numbered list that categorizes your financial activity into different accounts and subaccounts. Every nonprofit organization has a unique coa that depends on your specific programs, revenue sources,. It’s a series of line items, or accounts, that allows you to organize your accounting data. Web the nonprofit chart of accounts is an invaluable organizational structure for the nonprofit, serving as the basis from which all other reports, including the statement of financial position, statement of activities, statement of functional expenses, and statement of cash flows, will be sourced.. Web chart of accounts for nonprofit. These line items pertain to your financial position (or statement of financial position) and to your financial activities (or statement of activities). A chart of accounts is a systematic way to organize and track financial transactions using different “accounts”. It serves as the backbone for financial transactions and provides an organized structure to track. Web nonprofit chart of accounts: Web a chart of accounts is the foundation of a solid nonprofit group. Web [easily explained] watch on. You create this list to meet your organization’s unique needs. It’s a series of line items, or accounts, that allows you to organize your accounting data. Number, name, category type, and a short description. Manage your giving, accounting, budgeting, and more with aplos. Web establishing a nonprofit chart of accounts. The coa is a categorized collection of accounts where you have bookkeeping entries, including assets, liabilities, income and expenses. Web the chart of accounts (or coa) is a numbered list that categorizes your financial activity into different accounts and subaccounts. The stronger the foundation, the stronger the building — the same holds true for the chart of accounts. “nonprofits view their accounting processes through an accountability lens rather than one based solely on profitability and revenue generation…. Setting up your nonprofit chart of accounts from scratch can seem daunting. These line items pertain to your financial position (or statement of financial position) and to your financial activities (or statement of activities). Instead, it breaks these accounts into categories like assets, liabilities, income, expenses, and equity. Web nonprofit chart of accounts: Web a chart of accounts is a tool used by businesses and nonprofits to keep track of financial transactions, as shown in nonprofit financial statements. Web essentially, the chart of accounts is the foundation of effective nonprofit financial management and reporting. Web module 3 | special supplement — nonprofit charter school chart of accounts. Web your nonprofit chart of accounts is essentially an extensive filing cabinet. Compiling financial statements and preparing for audits.Quickbooks Chart Of Accounts Numbers

The Beginner’s Guide to Nonprofit Chart of Accounts

sample nonprofit chart of accounts

Nonprofit Chart Of Accounts Template

Nonprofit Chart Of Accounts Excel

Grow Your Nonprofit Organization With A Good Chart of Accounts Help

What Makes the Chart of Accounts for Nonprofits Unique

Chart Of Accounts Examples

Elegant Reporting in Nonprofit Accounting CLA (CliftonLarsonAllen)

sample nonprofit chart of accounts

Web In A Nonprofit’s Chart Of Accounts, Each Account Is Identified In Four Ways:

I Understood That When You Set The Organization To Nonprofit And The Tax Form To 990, That The Chart Of Accounts Would Change To Use Terms Like Income Instead Of Revenue For The Type.

The Chart Of Accounts For Your Organization Lists All Of Your Accounts.

This Guide And Example For Constructing A Nonprofit Chart Of Accounts Was Compiled By Jitasa On August 11, 2021.

Related Post: