Chart Of Accounts Non Profit

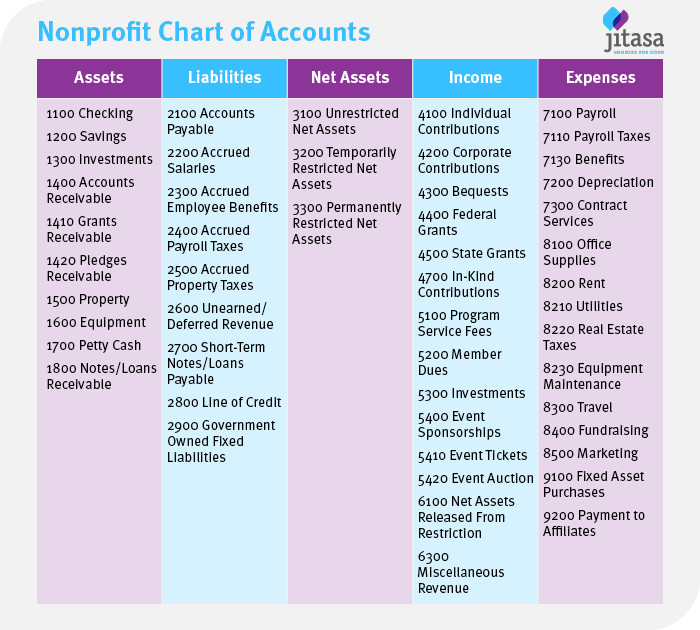

Chart Of Accounts Non Profit - At moneyminder the coa is called budget. Web the chart of accounts (or coa) is a numbered list that categorizes your financial activity into different accounts and subaccounts. Both the balance sheet and profit & loss reports follow the framework of your chart of accounts. Liabilities (like loans, mortgages, and accounts payable) should be in the 2000 range. It’s a series of line items, or accounts, that allows you to organize your accounting data. Web unified chart of accounts. Because the coa compiles so much information, this important resource can be daunting to create and challenging to keep up with, especially if you don’t fully understand its usefulness.” visit the guide and example. Web [easily explained] watch on. It functions as a directory of these records, making it the backbone. Each account in a coa represents a different type of financial transaction, such as revenue, expenses, assets, liabilities, and equity. The chart of accounts drives the appearance of your balance sheet and profit & loss reports. Web a chart of accounts is a detailed listing of minor categories under the major categories of assets, liabilities, net assets, revenues, and expenses. This list does not include all financial transactions. Web a chart of accounts is a tool used by businesses and. There are 3 elements to set your accounting up for success; Every nonprofit organization has a unique coa that depends on your specific programs, revenue sources, and activities. Web chart of accounts for nonprofit. Web nonprofit chart of accounts: The pdf file available for download below, will help you to produce your own nonprofit chart of accounts template. Web a chart of accounts is a tool used by businesses and nonprofits to keep track of financial transactions, as shown in nonprofit financial statements. Web the first step in organizing the nonprofit’s financial transactions is to create a chart of accounts. The stronger the foundation, the stronger the building — the same holds true for the chart of accounts.. Web a chart of accounts is a detailed listing of minor categories under the major categories of assets, liabilities, net assets, revenues, and expenses. It’s a series of line items, or accounts, that allows you to organize your accounting data. 3.2 net assets account codes nonprofit charter school accounting systems are organized and operated on a net asset class basis.. It is a listing of all the accounts in an organization and the debits and credits to each account. 3.2 net assets account codes nonprofit charter school accounting systems are organized and operated on a net asset class basis. Think of the chart of accounts as the foundation for a building you are about to construct. It functions as a. Web unified chart of accounts. The key to better reports is a shorter and more organized chart of accounts. Web what is a nonprofit chart of accounts? The overall accounting program, the accounting solution (or team), and the reports or documents. A coa categorizes an expense or revenue as either “revenue” or “expense.”. Think of the chart of accounts as the foundation for a building you are about to construct. Web get started with accounting for nonprofits. Web the chart of accounts (coa) tracks your various ledgers and everything your nonprofit does financially. While every organization has its own unique list of ledger accounts, following the general rules of practice simplifies reporting and. Web a chart of accounts is a detailed listing of minor categories under the major categories of assets, liabilities, net assets, revenues, and expenses. There’s a lot of planning and organization needed, making it hard to know where to begin. Revenue & expense coding by activity (revenue & expense only) page 7. It’s a series of line items, or accounts,. This list does not include all financial transactions. It is a financial document used by organizations with 501 (c) (3) status to account for the money they receive and spend. Web a chart of accounts is a detailed listing of minor categories under the major categories of assets, liabilities, net assets, revenues, and expenses. Web get started with accounting for. Web what is a nonprofit chart of accounts? Web get started with accounting for nonprofits. A chart of accounts is best managed through a detailed accounting program. We can view it as a map that helps navigate an organization’s financial landscape. Because the coa compiles so much information, this important resource can be daunting to create and challenging to keep. Web a non profit chart of accounts is used by a non profit organization, and is a list of the accounts found in the general ledger with an account code allocated to each account. Think of the chart of accounts as the foundation for a building you are about to construct. Web get started with accounting for nonprofits. Web the first step in organizing the nonprofit’s financial transactions is to create a chart of accounts. Because the coa compiles so much information, this important resource can be daunting to create and challenging to keep up with, especially if you don’t fully understand its usefulness.” visit the guide and example. Web a nonprofit chart of accounts (coa) is a guide that helps nonprofits classify and track expenses and revenue. The chart of accounts drives the appearance of your balance sheet and profit & loss reports. Web a chart of accounts actively lists all the accounts a company or nonprofit uses to record financial transactions. Web “a unified chart of accounts for nonprofits is a financial statement that includes all the assets, liabilities, equity and revenue or expense items. These line items pertain to your financial position (or statement of financial position) and to your financial activities (or statement of activities). I am new to qb and have a question about the chart of accounts. Any assets owned by your nonprofit (like bank accounts, investments, property, and equipment) should be numbered in the 1000 range. It is a listing of all the accounts in an organization and the debits and credits to each account. Instead, it breaks these accounts into categories like assets, liabilities, income, expenses, and equity. Many offer free accounts and fee waivers, and credit unions are. There are 3 elements to set your accounting up for success;Chart Of Accounts For Non Profit Church Chart Walls

Quickbooks Nonprofit Chart Of Accounts Pdf

Chart Of Accounts Example For Nonprofit

sample nonprofit chart of accounts

Nonprofit Chart of Accounts How to Get Started + Example

Nonprofit Accounting Software > QuickBooks® Enterprise Industry Solutions

:max_bytes(150000):strip_icc()/chart-of-accounts-984cd9454c364932b0cba045f56a6bb1.jpg)

Chart of Accounts (COA) Definition, How It Works, and Example

Non Profit Chart Of Accounts

How to set up a chart of accounts for your nonprofit organisation

Nonprofit Chart of Accounts Template Double Entry Bookkeeping

It Is A Financial Document Used By Organizations With 501 (C) (3) Status To Account For The Money They Receive And Spend.

The Stronger The Foundation, The Stronger The Building — The Same Holds True For The Chart Of Accounts.

I Understood That When You Set The Organization To Nonprofit And The Tax Form To 990, That The Chart Of Accounts Would Change To Use Terms Like Income Instead Of Revenue For The Type.

While Every Organization Has Its Own Unique List Of Ledger Accounts, Following The General Rules Of Practice Simplifies Reporting And Makes It Easier To Transition Into Different Software And Accounting Services.

Related Post: