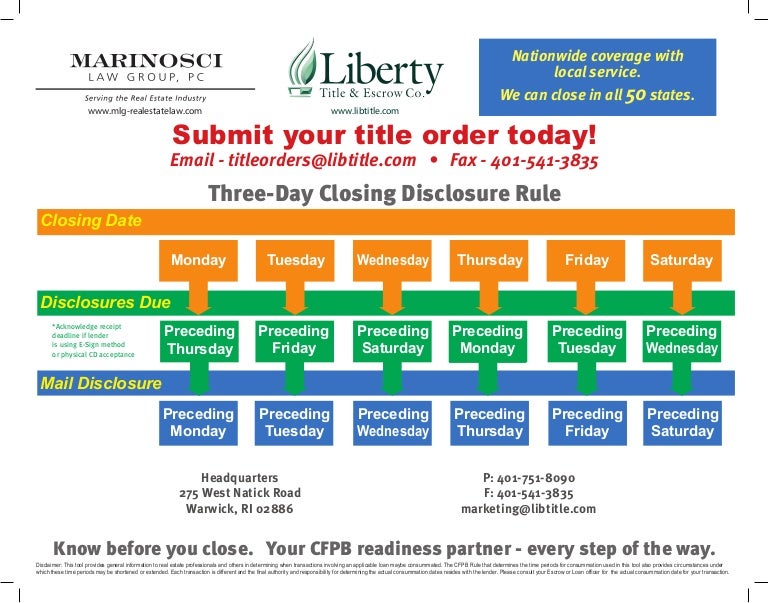

Closing Disclosure 3 Day Rule Chart

Closing Disclosure 3 Day Rule Chart - Thus, disclosures must be delivered electronically on the disclosures three days. Generally, if changes occur between the time the closing disclosure form. Disclosures may also be delivered electronically on the disclosures due date. Web use the chart below to help you determine when the closing disclosure should be sent to ensure the buyer receives it three days prior to consummation of the transaction. Friday would be day #1; Thus, disclosures must be delivered three days before closing, and not 72 hours prior to closing. Web on may 14, 2021, the bureau released frequently asked questions on housing assistance loans and how the build act impacts trid requirements for these loans. Thus, disclosures must be delivered three days before closing, and not 72 hours prior to closing. It’s important that you carefully. Web if the closing disclosure is acknowledged on a thursday, for example, the borrower can sign loan docs on the following monday; Thus, disclosures must be delivered three days before closing, and not 72 hours prior to closing. 10.2 the rule requires creditors to. Web thus, disclosures must be delivered three days before closing, and not 72 hours prior to closing. Web if the overstated apr is inaccurate under regulation z, the creditor must ensure that a consumer receives a corrected closing. Web if the closing disclosure is acknowledged on a thursday, for example, the borrower can sign loan docs on the following monday; Web on the rule (section 1.3) additional clarification on questions relating to the loan estimate and the 7 day waiting period (section 6.1 and 6.2). Web if the overstated apr is inaccurate under regulation z, the creditor must. Web use the chart below to help you determine when the closing disclosure should be sent to ensure the buyer receives it three days prior to consummation of. Web your lender is required to send you a closing disclosure that you must receive at least three business days before your closing. Generally, if changes occur between the time the closing. It’s important that you carefully. 10.2 the rule requires creditors to. To ensure you have enough time to review all of the numbers before signing your final paperwork, lenders are. Web use the chart below to help you determine when the closing disclosure should be sent to ensure the buyer receives it three days prior to consummation of. Web thus,. Thus, disclosures must be delivered three days before closing, and not 72 hours prior to closing. Web on may 14, 2021, the bureau released frequently asked questions on housing assistance loans and how the build act impacts trid requirements for these loans. Disclosures may also be delivered electronically on the disclosures due date. Friday would be day #1; To ensure. Web on the rule (section 1.3) additional clarification on questions relating to the loan estimate and the 7 day waiting period (section 6.1 and 6.2). To ensure you have enough time to review all of the numbers before signing your final paperwork, lenders are. Lenders are required to provide your. It’s important that you carefully. Web if the overstated apr. Your lender is required by law to give you the standardized closing disclosure at least 3 business days before. Web on the rule (section 1.3) additional clarification on questions relating to the loan estimate and the 7 day waiting period (section 6.1 and 6.2). Web if the overstated apr is inaccurate under regulation z, the creditor must ensure that a. Thus, disclosures must be delivered three days before closing, and not 72 hours prior to closing. Thus, disclosures must be delivered electronically on the disclosures three days. Web thus, disclosures must be delivered three days before closing, and not 72 hours prior to closing. 10.2 the rule requires creditors to. It’s important that you carefully. Friday would be day #1; Generally, if changes occur between the time the closing disclosure form. It’s important that you carefully. Thus, disclosures must be delivered three days before closing, and not 72 hours prior to closing. To ensure you have enough time to review all of the numbers before signing your final paperwork, lenders are. Thus, disclosures must be delivered three days before closing, and not 72 hours prior to closing. Web thus, disclosures must be delivered three days before closing, and not 72 hours prior to closing. 10.2 the rule requires creditors to. Web use the chart below to help you determine when the closing disclosure should be sent to ensure the buyer receives. Web on may 14, 2021, the bureau released frequently asked questions on housing assistance loans and how the build act impacts trid requirements for these loans. To ensure you have enough time to review all of the numbers before signing your final paperwork, lenders are. Your lender is required by law to give you the standardized closing disclosure at least 3 business days before. Thus, disclosures must be delivered three days before closing, and not 72 hours prior to closing. Thus, disclosures must be delivered electronically on the disclosures three days. Web on the rule (section 1.3) additional clarification on questions relating to the loan estimate and the 7 day waiting period (section 6.1 and 6.2). Generally, if changes occur between the time the closing disclosure form. Web use the chart below to help you determine when the closing disclosure should be sent to ensure the buyer receives it three days prior to consummation of. Web your lender is required to send you a closing disclosure that you must receive at least three business days before your closing. Disclosures may also be delivered electronically on the disclosures due date. Thus, disclosures must be delivered three days before closing, and not 72 hours prior to closing. It’s important that you carefully. Web if the overstated apr is inaccurate under regulation z, the creditor must ensure that a consumer receives a corrected closing disclosure at least three business. Friday would be day #1; Thus, disclosures must be delivered three days before closing, and not 72 hours prior to closing. Web if the closing disclosure is acknowledged on a thursday, for example, the borrower can sign loan docs on the following monday;

3day closing disclosure rule chart Calendar examples, Calendar

Three day closing disclosure rule TRID October 2015 from Liberty Titl…

How Closing Timeframes will be Impacted by the CFPB Ticor Title

The 3 Day Closing Disclosure Rule Twin City Title

The Fund The 3Day Closing Disclosure Rule

Prior Period Errors Disclosure Note Example Financial Statement

Closing Disclosure Timelines & The Three Day Rule

*Three Day Closing Rule Trid Compliance

Trid Calendar For Closing Calendar Template 2023

Sellers Apex Title & Closing Services, LLC.

Web Thus, Disclosures Must Be Delivered Three Days Before Closing, And Not 72 Hours Prior To Closing.

Web Use The Chart Below To Help You Determine When The Closing Disclosure Should Be Sent To Ensure The Buyer Receives It Three Days Prior To Consummation Of The Transaction.

10.2 The Rule Requires Creditors To.

Lenders Are Required To Provide Your.

Related Post: