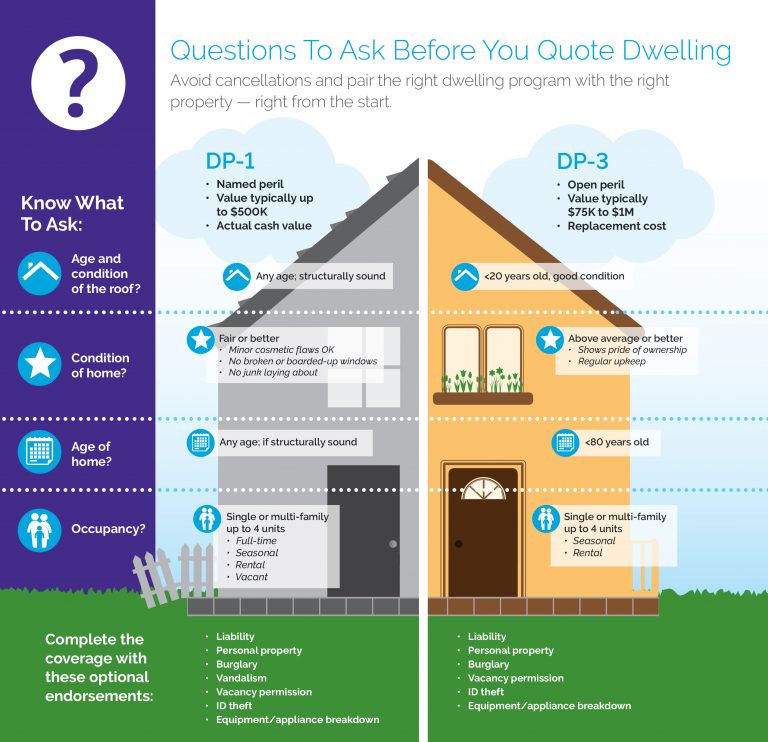

Dp1 Dp2 Dp3 Comparison Chart

Dp1 Dp2 Dp3 Comparison Chart - Covers only nine basic perils, lower cost; Web dp3, also known as a dwelling fire form 3 policy, offers more robust coverage than a dp1. The levels build on each other, with each succeeding level having the abilities of the previous level. Dp 1 is the most basic form of coverage of the three. Web according to imo guidelines, dp systems are rated dp1, dp2, or dp3. Web there are three kinds of landlord insurance: There are two other types of dwelling fire policies—dp2 and dp3 policies. The dp3 is the most extensive landlord insurance policy, providing the broadest and deepest coverage. Web the main difference between dp1 and dp2 is that dp2 covers more risks, eighteen in number, while dp1 covers nine. Choosing the policy that’s right for your rental property can take time and effort. The three forms, dp1, dp2, and dp3, vary in the amount of cover they offer, the way they settle payments, and other endorsements to provide stability and security to landlords. Web dwelling fire insurance policies come in two different policy categories; Dp 1 is the most basic form of coverage of the three. Named peril insurance policies are policies that. Web according to imo guidelines, dp systems are rated dp1, dp2, or dp3. It’s an open perils policy, which means it covers far more types of loss than dp1. Rather than listing a few covered perils, the dp3 covers. There are two other types of dwelling fire policies—dp2 and dp3 policies. For instance, dp2 covers burglary, malicious mischief, freezing pipes,. The dp3 is the most extensive landlord insurance policy, providing the broadest and deepest coverage. Dp1 systems are the most basic, with the ability to keep their position in. Web the difference between dp1, dp2, and dp3 policies. Covers 18 named perils, more comprehensive; The three forms, dp1, dp2, and dp3, vary in the amount of cover they offer, the. There are two other types of dwelling fire policies—dp2 and dp3 policies. Web what are the differences between dp1, dp2, and dp3 policies? Web the main difference between dp1 and dp2 is that dp2 covers more risks, eighteen in number, while dp1 covers nine. The dp3 is the most extensive landlord insurance policy, providing the broadest and deepest coverage. Named. Web what are the differences between dp1, dp2, and dp3 policies? Dp1 systems are the most basic, with the ability to keep their position in. Acv (can endorse to add replacement cost) acv (can endorse to add replacement cost) dwelling/other structures. Named perils vs open perils policies; The three forms, dp1, dp2, and dp3, vary in the amount of cover. Rather than listing a few covered perils, the dp3 covers. Web the main difference between dp1 and dp2 is that dp2 covers more risks, eighteen in number, while dp1 covers nine. Choosing the policy that’s right for your rental property can take time and effort. Acv (can endorse to add replacement cost) acv (can endorse to add replacement cost) dwelling/other. The dwelling fire form policies are a suitable type of insurance for landlords with occupied or vacant properties. Named peril insurance policies are policies that specifically list the perils that are insured under the policy. Named perils vs open perils policies; Choosing the policy that’s right for your rental property can take time and effort. Web dwelling fire insurance policies. Web there are three kinds of landlord insurance: Web according to imo guidelines, dp systems are rated dp1, dp2, or dp3. Web dp3, also known as a dwelling fire form 3 policy, offers more robust coverage than a dp1. Named peril insurance policies are policies that specifically list the perils that are insured under the policy. Rather than listing a. Dp1 systems are the most basic, with the ability to keep their position in. For instance, dp2 covers burglary, malicious mischief, freezing pipes, and falling objects, while dp1 does not cover these perils. Web dwelling fire insurance policies come in two different policy categories; Named peril insurance policies are policies that specifically list the perils that are insured under the. Web dwelling fire insurance policies come in two different policy categories; Web the three most common rental insurance policies are the dp1, dp2, and dp3. Web there are three kinds of landlord insurance: Web what are the differences between dp1, dp2, and dp3 policies? The dp1 is the most basic landlord insurance policy, providing very bare bones coverage. Acv (can endorse to add replacement cost) acv (can endorse to add replacement cost) dwelling/other structures. Dp 1 is the most basic form of coverage of the three. The levels build on each other, with each succeeding level having the abilities of the previous level. For instance, dp2 covers burglary, malicious mischief, freezing pipes, and falling objects, while dp1 does not cover these perils. Web what are the differences between dp1, dp2, and dp3 policies? Named peril policies and open peril policies. The dp1 is the most basic landlord insurance policy, providing very bare bones coverage. Web the difference between dp1, dp2, and dp3 policies. Web dp3, also known as a dwelling fire form 3 policy, offers more robust coverage than a dp1. Web dwelling fire insurance policies come in two different policy categories; It’s an open perils policy, which means it covers far more types of loss than dp1. Dp1 systems are the most basic, with the ability to keep their position in. Named peril insurance policies are policies that specifically list the perils that are insured under the policy. Choosing the policy that’s right for your rental property can take time and effort. Rather than listing a few covered perils, the dp3 covers. Web the three most common rental insurance policies are the dp1, dp2, and dp3..jpg)

DP3 Insurance Policy What it Covers and When It’s Useful

Dp1 Dp2 Dp3 Insurance Comparison Chart Michelle Ferrigno, Insurance

DP1 and DP3 comparison chart American Modern Insurance Agents

DP1 vs. DP2 vs. DP3 Which Insurance Policy Fits Your Needs?

Michelle Ferrigno, Insurance Agent Coverages Explained 'Landlord

.png)

DP1 vs. DP2 vs. DP3 Which Insurance Policy Fits Your Needs?

Resources Ricci Insurance Group

Dp1 Dp2 Dp3 Insurance Parison Charts Reviews Of Chart

Dp1 Dp2 Dp3 Insurance Comparison Chart Michelle Ferrigno, Insurance

Dp1 Dp2 Dp3 Insurance Comparison Chart Michelle Ferrigno, Insurance

Covers Only Nine Basic Perils, Lower Cost;

Named Perils Vs Open Perils Policies;

Web The Main Difference Between Dp1 And Dp2 Is That Dp2 Covers More Risks, Eighteen In Number, While Dp1 Covers Nine.

Web Dp1, Dp2 , Dp3:

Related Post: