Globe Life Cash Value Chart

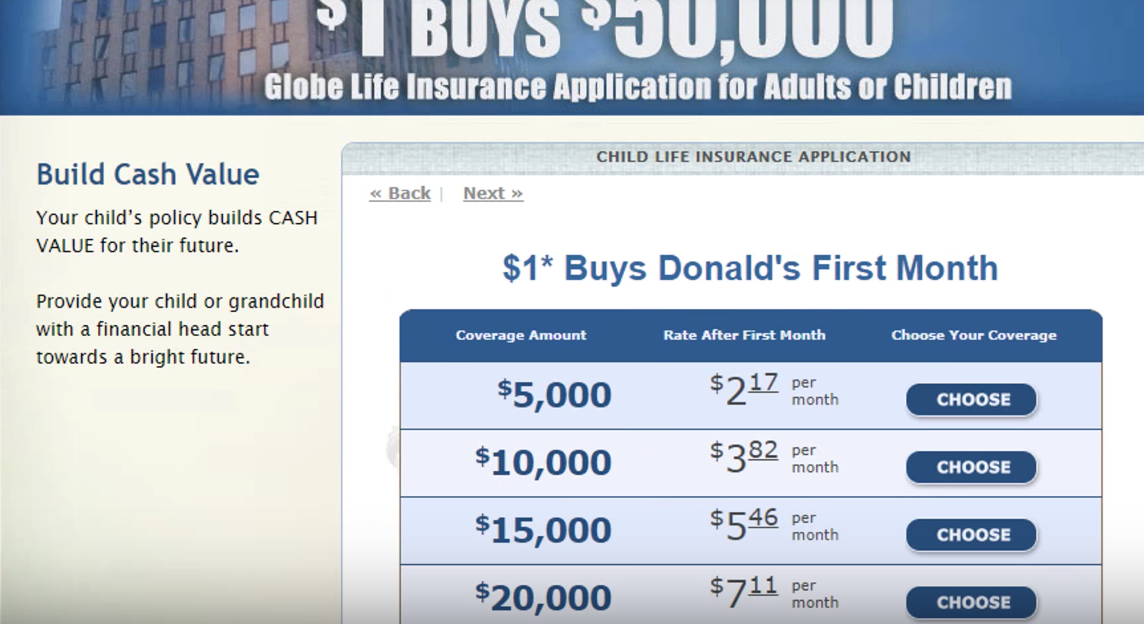

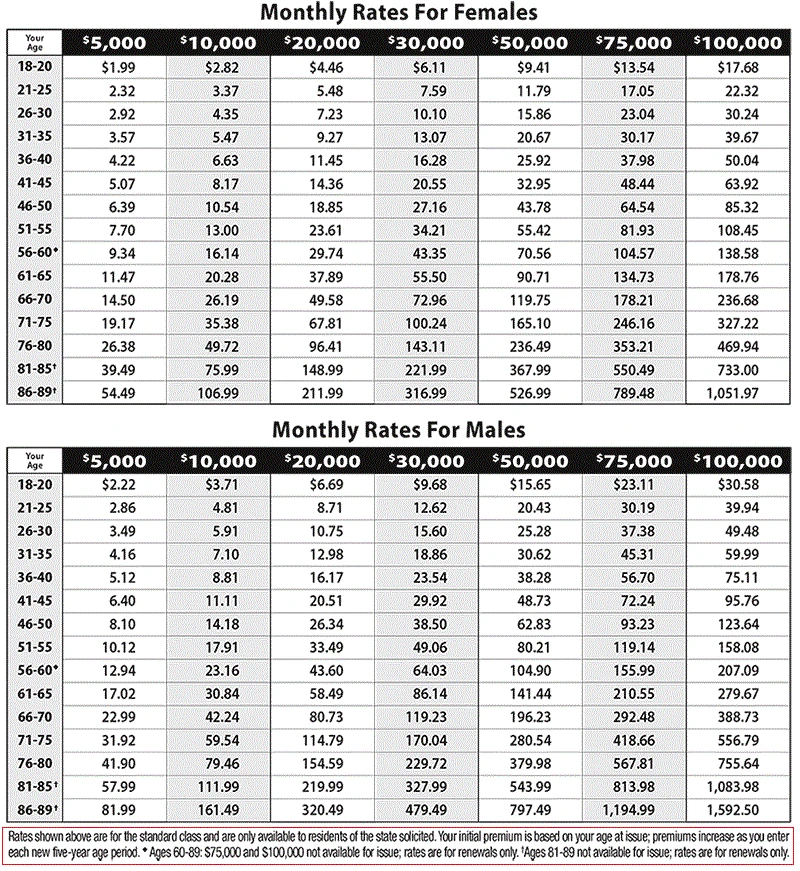

Globe Life Cash Value Chart - Also, the price will increase every five years, and the coverage will terminate on your 80th or 90th birthday (varies by state). Can you borrow money from a life insurance policy? You can decide to borrow against the value of the policy or eventually surrender the policy. $2.17 for children or grandchildren. Web whole life insurance cash value charts. Web $5,000, $10,000, $20,000, $30,000, or even $50,000 of coverage. Monthly rates as low as: No waiting period full coverage the first day. The cash value of your policy won't be added to the death benefit, but it grows at a guaranteed rate over time. Cashing out a life insurance policy. Can you borrow money from a life insurance policy? (many of the links in this article redirect to a specific reviewed product. You can decide to borrow against the value of the policy or eventually surrender the policy. Web permanent life insurance typically lasts a lifetime and builds cash value that can be borrowed against in the future. Cashing out. No medical exam — simple application. No waiting period full coverage the first day. That means you will never see an increase in premiums for any reason. Web when you pass away, the cash value of your life insurance policy remains with the insurance company in most cases, meaning the accumulated cash value funds aren’t paid out to your beneficiaries.. Globe life offers payouts between $5,000 to $50,000, mostly in increments of $10,000. Web when you pass away, the cash value of your life insurance policy remains with the insurance company in most cases, meaning the accumulated cash value funds aren’t paid out to your beneficiaries. Web permanent life insurance typically lasts a lifetime and builds cash value that can. No waiting period full coverage the first day. Cash value life insurance, also known as permanent life insurance, includes a cash component in addition to a death benefit, which is. *$1 pays for the first month of coverage. Web $5,000, $10,000, $20,000, $30,000, or even $50,000 of coverage. Monthly rates as low as: In the examples below, guaranteed value numbers show a situation where there are no dividends paid and policy costs reach the maximum limit. Web $5,000, $10,000, $20,000, $30,000, or even $50,000 of coverage. Web when you pass away, the cash value of your life insurance policy remains with the insurance company in most cases, meaning the accumulated cash value funds. Cashing out a life insurance policy. Cash value life insurance, also known as permanent life insurance, includes a cash component in addition to a death benefit, which is. No medical exam — simple application. Web whole life insurance cash value charts. No medical exam — simple application. You can decide to borrow against the value of the policy or eventually surrender the policy. In the examples below, guaranteed value numbers show a situation where there are no dividends paid and policy costs reach the maximum limit. No medical exam — simple application. How to cash out a globe life insurance policy. $2.17 for children or grandchildren. Monthly rates as low as: Web when you pass away, the cash value of your life insurance policy remains with the insurance company in most cases, meaning the accumulated cash value funds aren’t paid out to your beneficiaries. Cashing out a life insurance policy. You can decide to borrow against the value of the policy or eventually surrender the policy.. You can decide to borrow against the value of the policy or eventually surrender the policy. No waiting period full coverage the first day. *$1 pays for the first month of coverage. How to cash out a globe life insurance policy. (many of the links in this article redirect to a specific reviewed product. No waiting period full coverage the first day. Cashing out a life insurance policy. Web funeral costs typically reach about $10,000; Globe life insurance monthly rates start at $1.99 and go up to $1,592, depending on your age, gender, and death benefit. Monthly rates as low as: Instead, your beneficiaries receive the death benefit of your policy as outlined in the terms of your coverage. Also, the price will increase every five years, and the coverage will terminate on your 80th or 90th birthday (varies by state). Cashing out a life insurance policy. *$1 pays for the first month of coverage. Monthly rates as low as: Globe life insurance monthly rates start at $1.99 and go up to $1,592, depending on your age, gender, and death benefit. No waiting period full coverage the first day. After the first month, your affordable rates are based on your age and stay the same for life. Monthly rates as low as: You can decide to borrow against the value of the policy or eventually surrender the policy. No waiting period full coverage the first day. Web funeral costs typically reach about $10,000; Globe life insurance rate charts by age. The cash value of your policy won't be added to the death benefit, but it grows at a guaranteed rate over time. Globe life offers payouts between $5,000 to $50,000, mostly in increments of $10,000. Looking to cash out your globe life insurance policy?

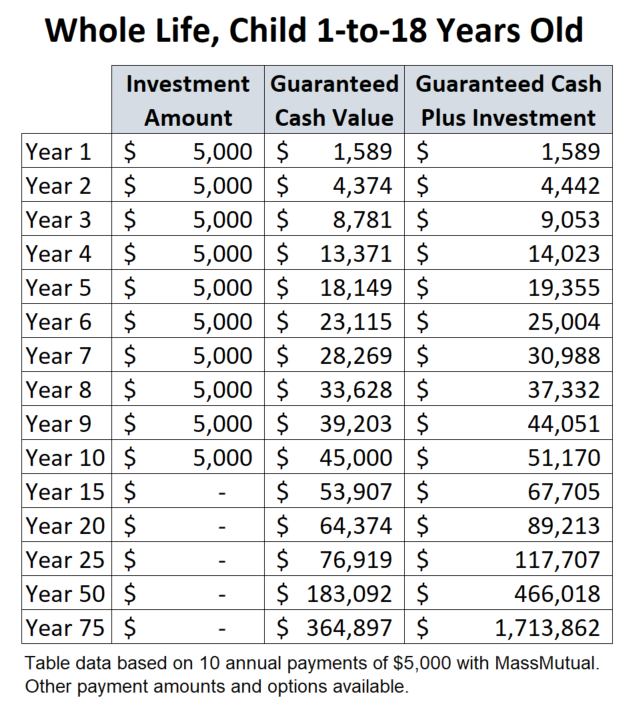

A Great Way to Invest for Kids Double Eagle Insurance Agency

Whole Life Insurance Rates by Age for 2023

Arlington Baseball Stadium Seating Chart

How Long Does It Take For Whole Life Insurance To Build Cash Value

Whole Life Insurance Calculator Cash Value

Globe Life Insurance Rates Thismylife Lovenhate

Globe Life Insurance Rates Chart 3 Surprising Insights GetSure

![Life Insurance For Children [the Best Policies for Kids]](https://www.insuranceandestates.com/wp-content/uploads/whole-life-insurance-illustration-5-yo-boy-pt-2.jpg)

Life Insurance For Children [the Best Policies for Kids]

![Globe Life Insurance Review [Best Coverages + 2024 Rates] » Effortless](https://www.effortlessinsurance.com/wp-content/uploads/2020/05/2f158cb4-globe-life-insurance-whole-life-for-children.png)

Globe Life Insurance Review [Best Coverages + 2024 Rates] » Effortless

2024 Globe Life Insurance Review (Prices, Pros & Cons)

(Many Of The Links In This Article Redirect To A Specific Reviewed Product.

Can You Borrow Money From A Life Insurance Policy?

No Medical Exam — Simple Application.

$2.17 For Children Or Grandchildren.

Related Post: