Look At The Below Yield Curve Inversion Chart

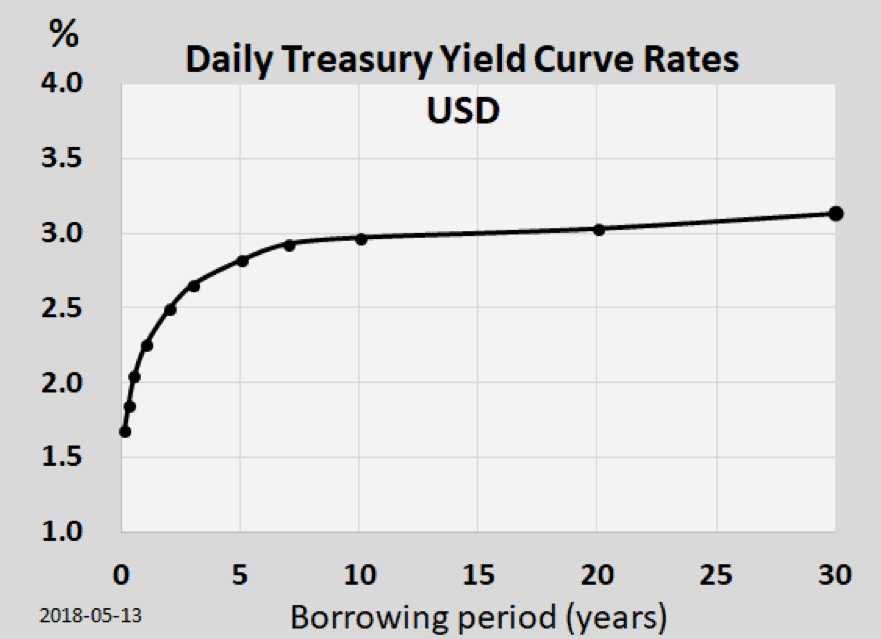

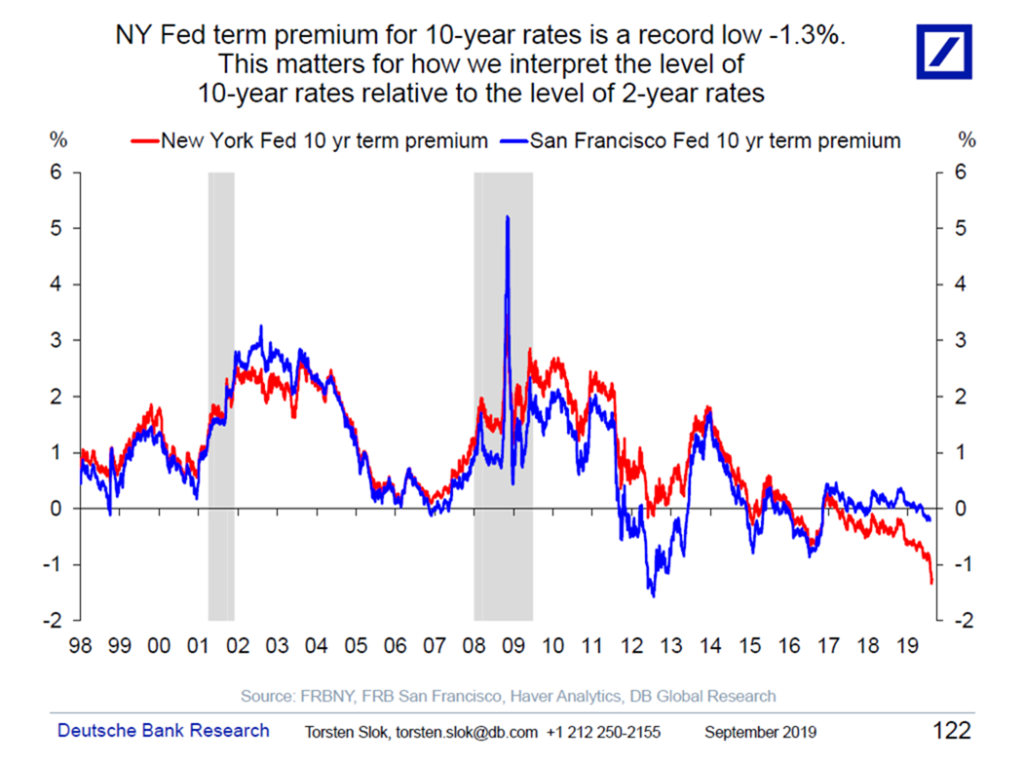

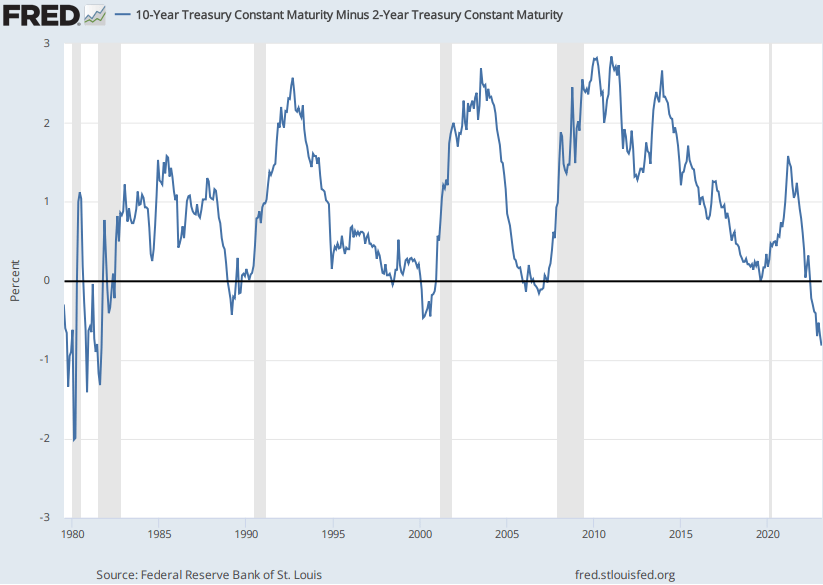

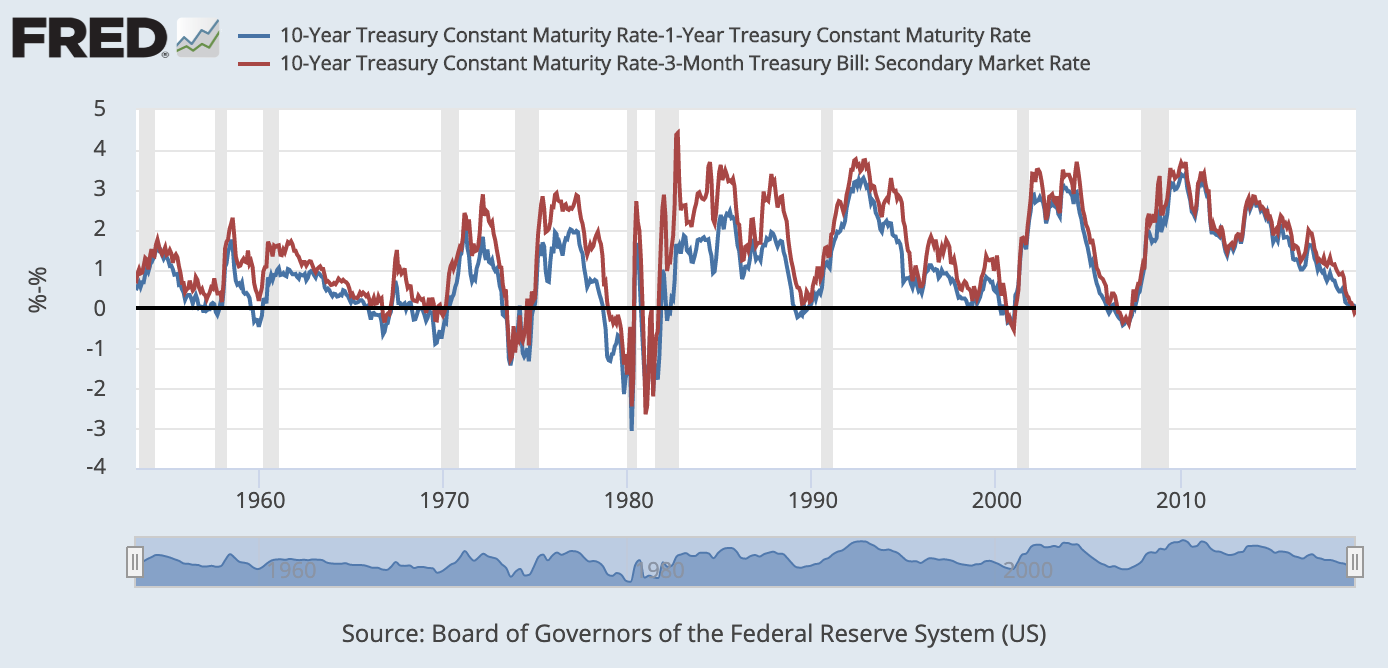

Look At The Below Yield Curve Inversion Chart - A yield curve reflects the current yields for debt obligations of various terms. April 2021 shows the normal upward sloping yield curve, may 2007 shows a flat yield curve, and august 2000 shows an inverted yield curve. What is most likely to happen as a result of the most recent yield curve inversion shown? Download visual | modify in ycharts. The chart below shows this: Treasury rates can be plotted based on maturity, and normally, that’s an upward sloping line with more risk (time) compensated by greater return (yield). Web look at the below yield curve inversion chart. As can be seen, the share of long term investors has been progressively rising over the past few years. When they flip, or invert, it’s widely regarded as a bad. Web a yield curve is a line that plots yields, or interest rates, of bonds that have equal credit quality but differing maturity dates. Gdp will rise gdp will dip term premium will rise. It shows interest rates on u.s. Knowledge check look at the below yield curve inversion chart. What is most likely to happen as a result of the most recent yield curve inversion shown? What is most likely to happen as a result of the most recent yield curve inversion shown? The slope of the yield curve can predict future interest rate. In normal economic conditions, investors are rewarded with higher interest rates for holding bonds over longer time periods, resulting in an upward sloping yield curve. Sometimes only part (s) of the curve are inverted; Gdp will rise gdp will dip term premium will rise. A yield curve reflects the. From an investor standpoint, predicting what will happen to. The gray shaded areas on the chart are recessions. Treasury debt at different maturities at a given. As can be seen, the share of long term investors has been progressively rising over the past few years. What is most likely to happen as a result of the most recent yield curve. Web economics questions and answers. In normal economic conditions, investors are rewarded with higher interest rates for holding bonds over longer time periods, resulting in an upward sloping yield curve. Sometimes only part (s) of the curve are inverted; What is most likely to happen as a result of the most recent yield curve inversion shown? An inverted yield curve. An invested yield curve is viewed as an important. Web look at the below yield curve inversion chart. Knowledge check look at the below yield curve inversion chart. As can be seen, the share of long term investors has been progressively rising over the past few years. Term premium will remain constant. April 2021 shows the normal upward sloping yield curve, may 2007 shows a flat yield curve, and august 2000 shows an inverted yield curve. Web the left graph selects three different time periods to show the three different yield curve shapes: In normal economic conditions, investors are rewarded with higher interest rates for holding bonds over longer time periods, resulting. Treasury rates can be plotted based on maturity, and normally, that’s an upward sloping line with more risk (time) compensated by greater return (yield). Knowledge check look at the below yield curve inversion chart. Sometimes only part (s) of the curve are inverted; Download visual | modify in ycharts. In normal economic conditions, investors are rewarded with higher interest rates. 1 in the postwar era, a “normal” yield curve has been upward sloping, meaning that. Web to get at the answer, let’s look at what an inverted yield curve is and what it means for a likely 2023 recession. The chart below shows this: It shows interest rates on u.s. April 2021 shows the normal upward sloping yield curve, may. Web look at the below yield curve inversion chart. When they flip, or invert, it’s widely regarded as a bad. Web look at the below yield curve inversion chart. As can be seen, the share of long term investors has been progressively rising over the past few years. The slope of the yield curve can predict future interest rate. Despite the name, an inverted yield curve does not have to be “completely” inverted. Treasuries are the backbone of the global financial system. Web 2022 inverted yield curve. The gray shaded areas on the chart are recessions. Web a yield curve is a line that plots yields, or interest rates, of bonds that have equal credit quality but differing maturity. Web a more ‘real world’ way of looking at the evolving shape of the curve is to track how the relative importance of various investor classes is changing in the government bond market. The slope of the yield curve can predict future interest rate. Web the event — commonly dubbed a yield curve inversion — was largely viewed as a signal the u.s. Web a yield curve is a line that plots yields, or interest rates, of bonds that have equal credit quality but differing maturity dates. Web generally speaking, the yield curve is a line chart that plots interest rates for bonds that have equal credit quality, but different maturity dates. 1 in the postwar era, a “normal” yield curve has been upward sloping, meaning that. What is most likely to happen as a result of the most recent yield curve inversion shown? Web the yield curve is a visual representation of how much it costs to borrow money for different periods of time; Web economics questions and answers. Despite the name, an inverted yield curve does not have to be “completely” inverted. What is most likely to happen as a result of the most recent yield curve inversion shown? Gdp will rise gdp will dip term premium will rise. An inverted yield curve occurs when. Sometimes only part (s) of the curve are inverted; As can be seen, the share of long term investors has been progressively rising over the past few years. It shows interest rates on u.s.

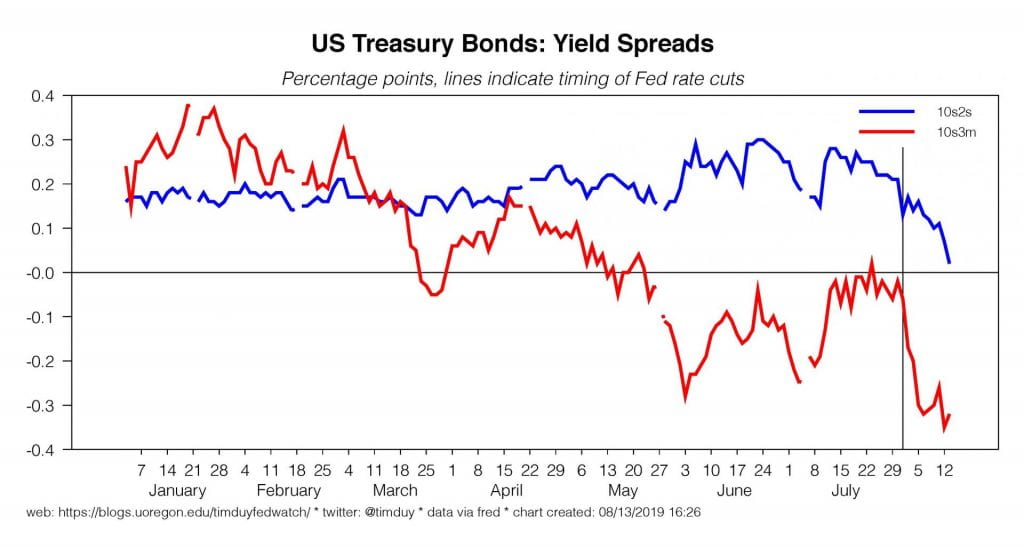

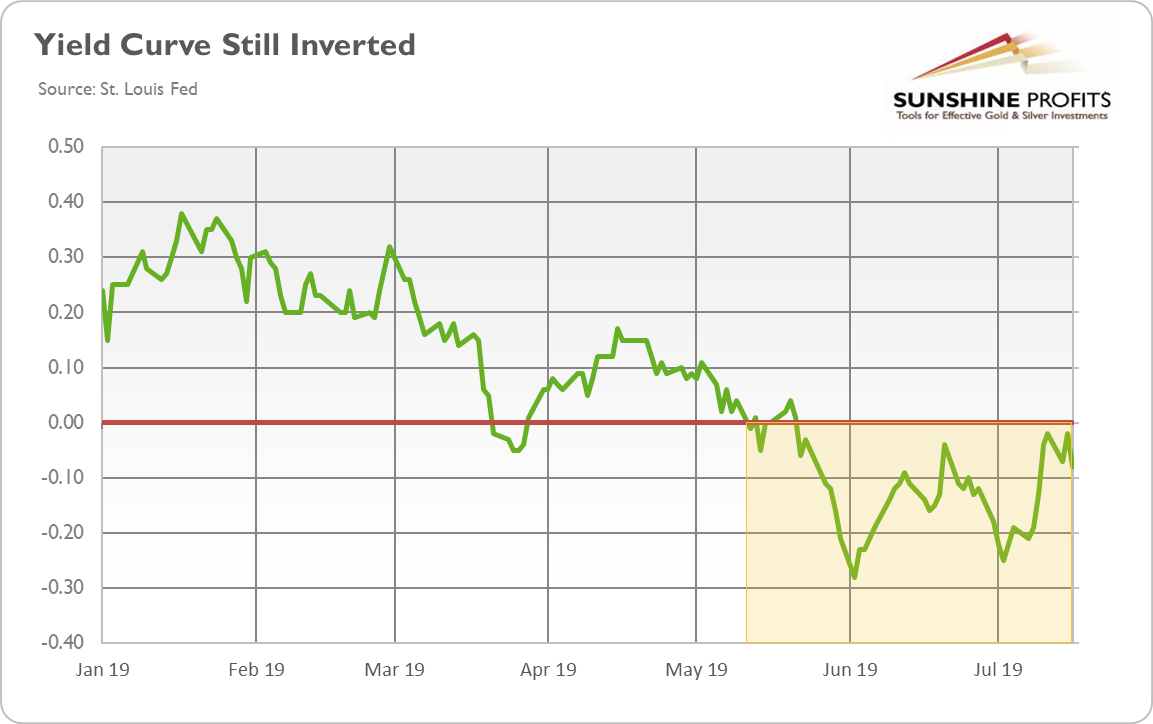

Another Portion of Yield Curve Heading Toward Inversion Tim Duy's Fed

2020 Recession Watch & Yield Curve 101 w Heidi Moore & Josh Brown

What is Yield Curve Inversion? Barber Financial Group

Interpreting the Yield Curve Inversion The Big Picture

OneClass Look at the below yield curve inversion chart. What is most

Yield Curve inversion revisits a multidecade record, as its widened 85

Inversion of the Yield Curve It’s Different This Time? — Plains Advisory

History Of Yield Curve Inversions And Gold Gold Eagle

Data Behind Fear of Yield Curve Inversions The Big Picture

An Average Singaporean's Guide To What Does The Yield Curve Inversion

The Gray Shaded Areas On The Chart Are Recessions.

From An Investor Standpoint, Predicting What Will Happen To.

Here Is A Quick Primer On What An Inverted Yield Curve Means, How It Has Predicted Recession, And What It Might Be.

Treasury Rates Can Be Plotted Based On Maturity, And Normally, That’s An Upward Sloping Line With More Risk (Time) Compensated By Greater Return (Yield).

Related Post: