Megaphone Chart Pattern

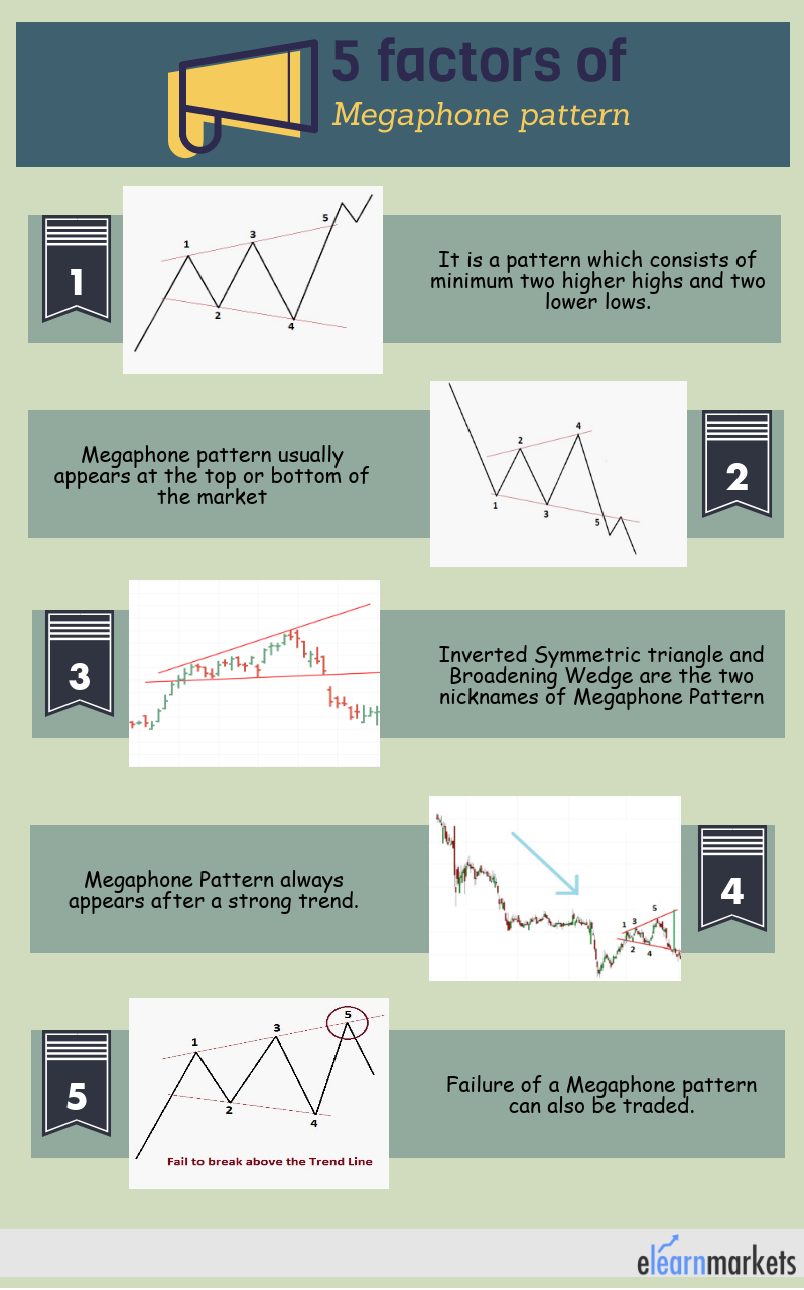

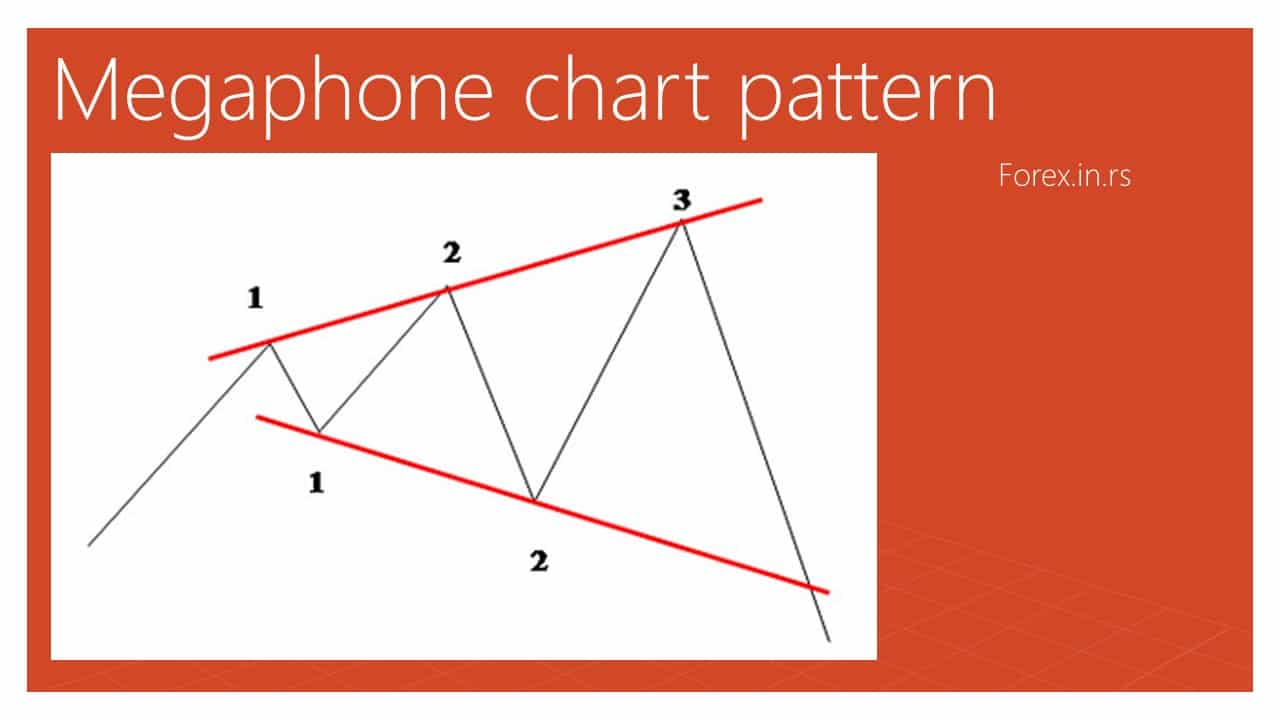

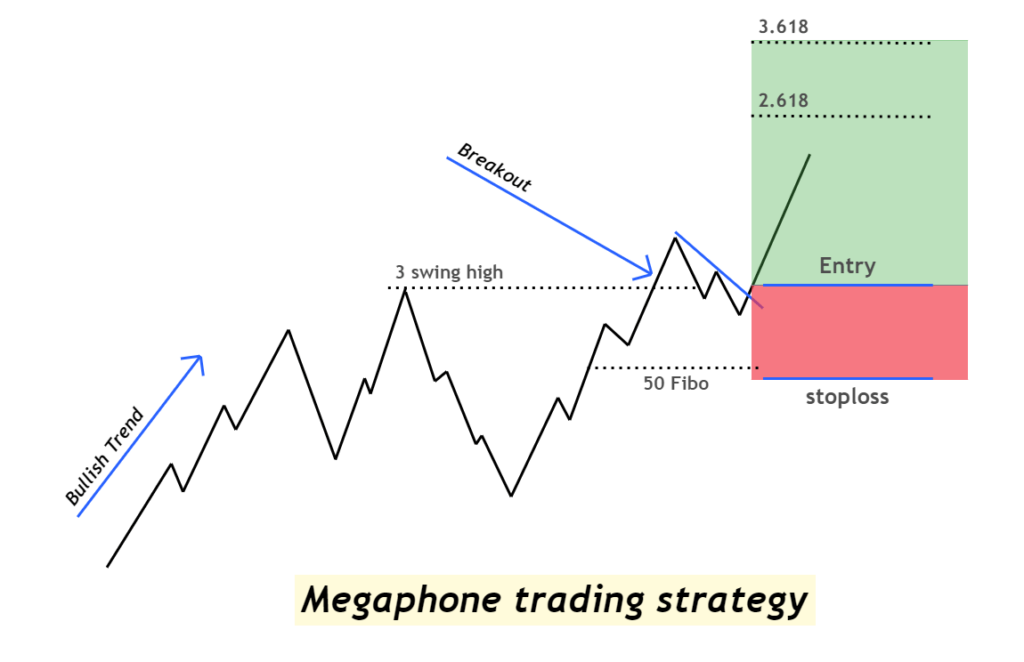

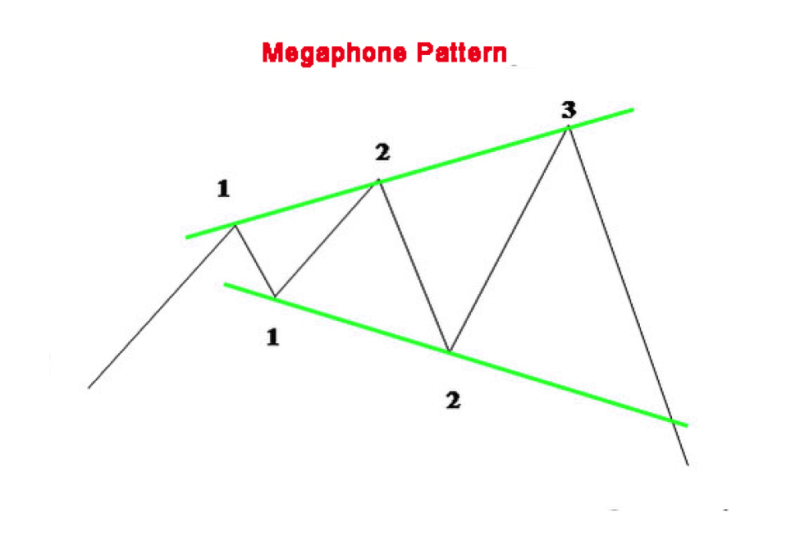

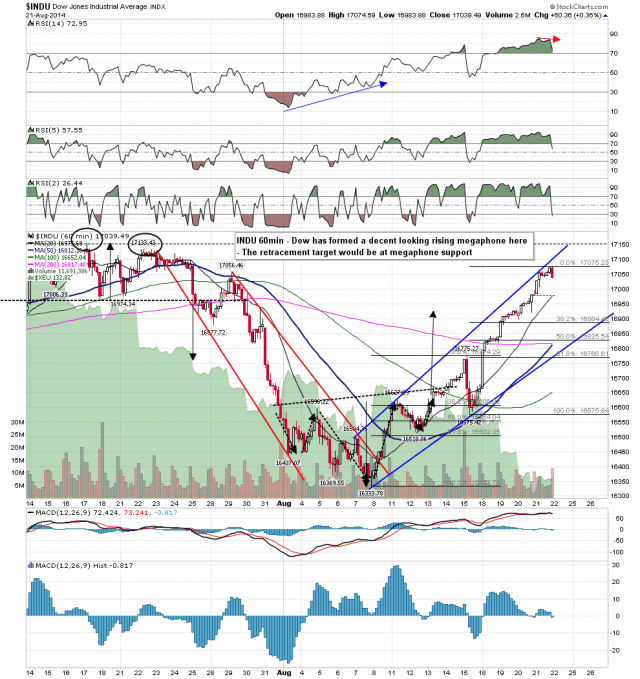

Megaphone Chart Pattern - One chart pattern in the stock market is the megaphone. It shows what's happening real time. Trading broadening tops and bottoms (the megaphone pattern) what is a megaphone pattern & how to identify these patterns? It consists of at least two higher highs and two lower lows formed from five different swings. A megaphone pattern is a chart pattern that occurs when the price movement becomes volatile. How to trade a megaphone pattern? Generally, the megaphone pattern consists of 5 different swings. The greater the time frame is the better. This pattern is useful for technical analysis as it helps traders predict possible future price movements. The price may reflect the random disagreement between. Our free ebook covers the most popular patterns and how to trade them. Web when connecting these highs and lows, the trend lines form a widening pattern that looks like a megaphone or reverse symmetrical triangle. The greater the time frame is the better. The price may reflect the random disagreement between. Web how to identify the megaphone pattern? Though often seen as bearish due to its volatility and uncertainty, its historical performance makes it ambiguous. Our free ebook covers the most popular patterns and how to trade them. Web a megaphone pattern in trading is a chart pattern that occurs when price movement becomes volatile. Web a broadening top is a unique chart pattern resembling a reverse triangle. Web a megaphone pattern in trading is a chart pattern that occurs when price movement becomes volatile. Though often seen as bearish due to its volatility and uncertainty, its historical performance makes it ambiguous. Web how to identify the megaphone pattern? Web a broadening top is a unique chart pattern resembling a reverse triangle or megaphone that signals significant volatility. Trading broadening tops and bottoms (the megaphone pattern) what is a megaphone pattern & how to identify these patterns? It consists of at least two higher highs and two lower lows formed from five different swings. The pattern is generally formed when the market is highly volatile in nature and traders are not confident about the market direction. Web a. Web the megaphone chart pattern provides unique entries and exits off different sides of its structure. The price may reflect the random disagreement between. But the swing has to have a minimum of two higher highs and two lower lows. It consists of at least two higher highs and two lower lows formed from five different swings. Price action is. Normally this pattern is visible when the market is at its top or bottom. It shows what's happening real time. Web when connecting these highs and lows, the trend lines form a widening pattern that looks like a megaphone or reverse symmetrical triangle. Our free ebook covers the most popular patterns and how to trade them. A trend line is. Web how to identify megaphone pattern stocks—are they bullish or bearish? The greater the time frame is the better. A megaphone pattern consists of a bunch of candlesticks that form a big sloping megaphone shaped pattern. Price action is the most important indicator to learn when trading. Web a megaphone pattern in trading is a chart pattern that occurs when. Web megaphone pattern is a pattern which consists of minimum two higher highs and two lower lows. It shows what's happening real time. A trend line is drawn by connecting point 1 and point 3 while points 2 and 4 are also joined together to draw a line. Generally, the megaphone pattern consists of 5 different swings. A megaphone pattern. Though often seen as bearish due to its volatility and uncertainty, its historical performance makes it ambiguous. Generally, the megaphone pattern consists of 5 different swings. Web a megaphone pattern in trading is a chart pattern that occurs when price movement becomes volatile. Web the megaphone chart pattern provides unique entries and exits off different sides of its structure. Web. A trend line is drawn by connecting point 1 and point 3 while points 2 and 4 are also joined together to draw a line. The pattern is generally formed when the market is highly volatile in nature and traders are not confident about the market direction. One chart pattern in the stock market is the megaphone. Web how to. Web how to identify the megaphone pattern? Trading broadening tops and bottoms (the megaphone pattern) what is a megaphone pattern & how to identify these patterns? Our free ebook covers the most popular patterns and how to trade them. Web a megaphone pattern in trading is a chart pattern that occurs when price movement becomes volatile. Normally this pattern is visible when the market is at its top or bottom. Price action is the most important indicator to learn when trading. Web megaphone pattern is a pattern which consists of minimum two higher highs and two lower lows. The price may reflect the random disagreement between. How to trade a megaphone pattern? The greater the time frame is the better. A trend line is drawn by connecting point 1 and point 3 while points 2 and 4 are also joined together to draw a line. A megaphone pattern consists of a bunch of candlesticks that form a big sloping megaphone shaped pattern. Web megaphone pattern in technical analysis chart trading bullish and bearish explanation with guide!👉get my technical analysis course here: It consists of at least two higher highs and two lower lows formed from five different swings. Though often seen as bearish due to its volatility and uncertainty, its historical performance makes it ambiguous. This pattern is useful for technical analysis as it helps traders predict possible future price movements.

Megaphone Pattern The Art of Trading like a Professional

Megaphone Chart Pattern Success Rate Case Study Forex Education

Megaphone Pattern The Art of Trading like a Professional

Bearish and Bullish Megaphone pattern A Complete Guide ForexBee

Megaphone Chart Pattern Free Patterns

Learn To Spot The Megaphone Pattern • Asia Forex Mentor

Megaphone, High & Low, Complete Guide, Forex, Promotion, Chart

Everything You Need to Know To Trade A Trend Line Strategy

Megaphone chart pattern

USD Megaphone pattern for TVCDXY by mmmoguschiy — TradingView

While It's Rare, It Can Tell You A Lot About Where A Stock Is.

Web A Broadening Top Is A Unique Chart Pattern Resembling A Reverse Triangle Or Megaphone That Signals Significant Volatility And Disagreement Between Bullish And Bearish Investors.

The Pattern Is Generally Formed When The Market Is Highly Volatile In Nature And Traders Are Not Confident About The Market Direction.

Web When Connecting These Highs And Lows, The Trend Lines Form A Widening Pattern That Looks Like A Megaphone Or Reverse Symmetrical Triangle.

Related Post: