Nebraska Sales Tax Exemption Chart

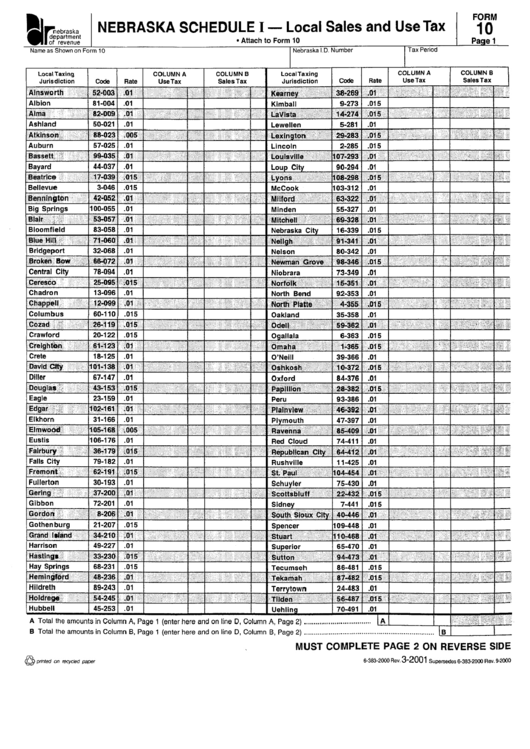

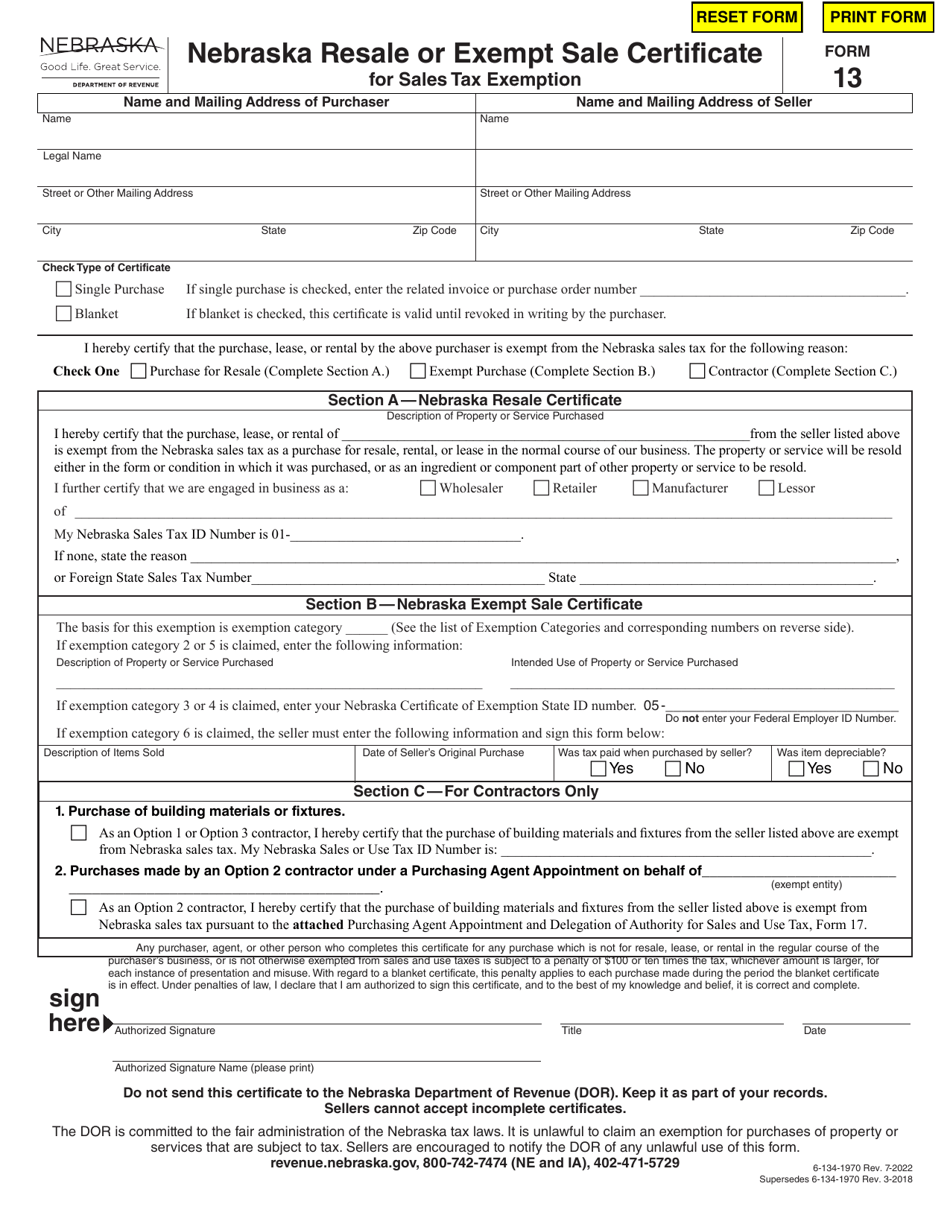

Nebraska Sales Tax Exemption Chart - Web the rate in nebraska, or if sales tax has been properly paid in nebraska, no use tax is. Web use tax are listed in the nebraska sales tax exemption chart. Web we last updated the nebraska resale or exempt sale certificate for sales tax. Audit support guaranteeeasy and accurate The list includes aircraft, labor, property, interstate commerce, industrial. The 20th of the month following. Web nebraska sales tax exemptions chart. You can use our nebraska sales tax calculator to. Web nebraska sales tax calculator. Sales tax return due date. Web use tax are listed in the nebraska sales tax exemption chart. Web nebraska sales tax calculator. Web nebraska sales tax exemptions chart. Audit support guaranteeeasy and accurate Web we last updated the nebraska resale or exempt sale certificate for sales tax. Web we last updated the nebraska resale or exempt sale certificate for sales tax. Sales tax return due date. Web nebraska sales tax calculator. Print this table | next. Web the nebraska department of revenue feb. Web the nebraska department of revenue feb. Web some customers are exempt from paying sales tax under nebraska law. Print this table | next. The list includes aircraft, labor, property, interstate commerce, industrial. Web nebraska sales tax exemptions chart. Web the nebraska department of revenue feb. Audit support guaranteeeasy and accurate Web use tax are listed in the nebraska sales tax exemption chart. Web these can range from 0.5% to 2%, bringing the total sales tax rate to between 6% and. Web nebraska sales tax calculator. Web the nebraska department of revenue feb. Web the rate in nebraska, or if sales tax has been properly paid in nebraska, no use tax is. Web generally, the sales tax base in nebraska is any retail sale of tangible personal property,. The list includes aircraft, labor, property, interstate commerce, industrial. Web we last updated the nebraska resale or exempt. Web some customers are exempt from paying sales tax under nebraska law. Web we last updated the nebraska resale or exempt sale certificate for sales tax. Web the nebraska department of revenue feb. Web the rate in nebraska, or if sales tax has been properly paid in nebraska, no use tax is. Web nebraska sales tax calculator. Web some customers are exempt from paying sales tax under nebraska law. The list includes aircraft, labor, property, interstate commerce, industrial. The 20th of the month following. Web these can range from 0.5% to 2%, bringing the total sales tax rate to between 6% and. You can use our nebraska sales tax calculator to. Web the nebraska department of revenue feb. Web 60 rows nebraska resale or exempt sale certificate for sales tax exemption. Web the rate in nebraska, or if sales tax has been properly paid in nebraska, no use tax is. Web we last updated the nebraska resale or exempt sale certificate for sales tax. Web 5.50% maximum local & county rates: The list includes aircraft, labor, property, interstate commerce, industrial. The 20th of the month following. Web nebraska sales tax calculator. Web generally, the sales tax base in nebraska is any retail sale of tangible personal property,. Web 60 rows nebraska resale or exempt sale certificate for sales tax exemption. Web 5.50% maximum local & county rates: Web nebraska sales tax calculator. Web the nebraska department of revenue feb. Print this table | next. Web these can range from 0.5% to 2%, bringing the total sales tax rate to between 6% and. Print this table | next. Web use tax are listed in the nebraska sales tax exemption chart. Web these can range from 0.5% to 2%, bringing the total sales tax rate to between 6% and. Web the rate in nebraska, or if sales tax has been properly paid in nebraska, no use tax is. Web find the list of sales tax exemptions for various business and agricultural activities in nebraska, with the documentation and additional information required for each exemption. Web generally, the sales tax base in nebraska is any retail sale of tangible personal property,. Web 60 rows nebraska resale or exempt sale certificate for sales tax exemption. Web some customers are exempt from paying sales tax under nebraska law. Web nebraska sales tax calculator. Sales tax return due date. The 20th of the month following. Web 5.50% maximum local & county rates: The list includes aircraft, labor, property, interstate commerce, industrial. Web the nebraska department of revenue feb.

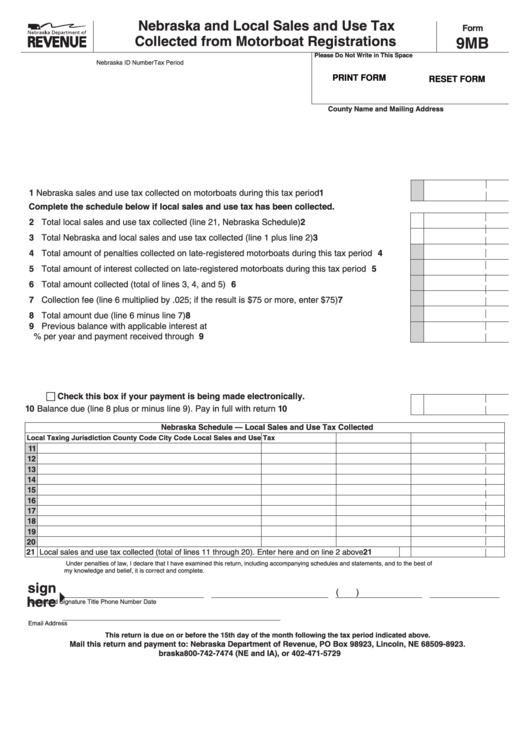

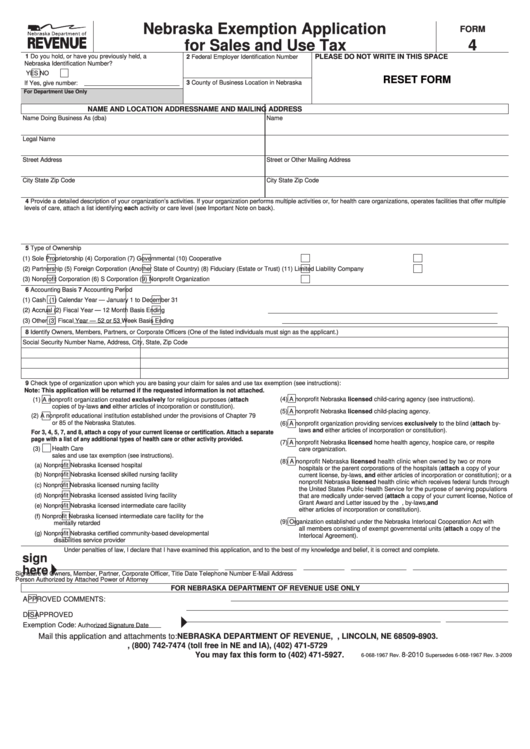

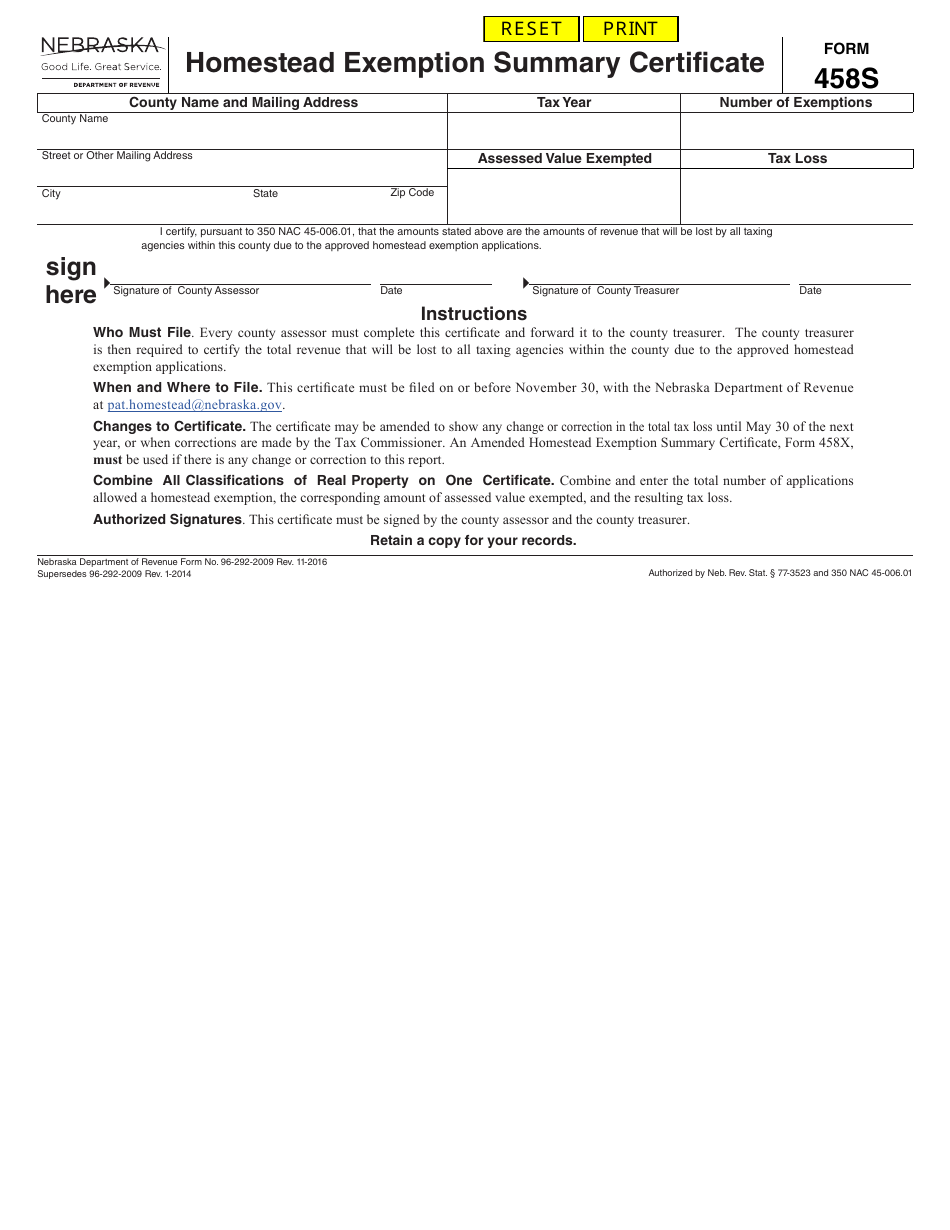

Top 26 Nebraska Sales Tax Form Templates free to download in PDF format

Nebraska Sales Tax Guide for Businesses

Fillable Form 4 Nebraska Exemption Application For Sales And Use Tax

5 Weird Nebraska Sales Tax Exemptions

Form 10 Nebraska Schedule I Local Sales And Use Tax 2000

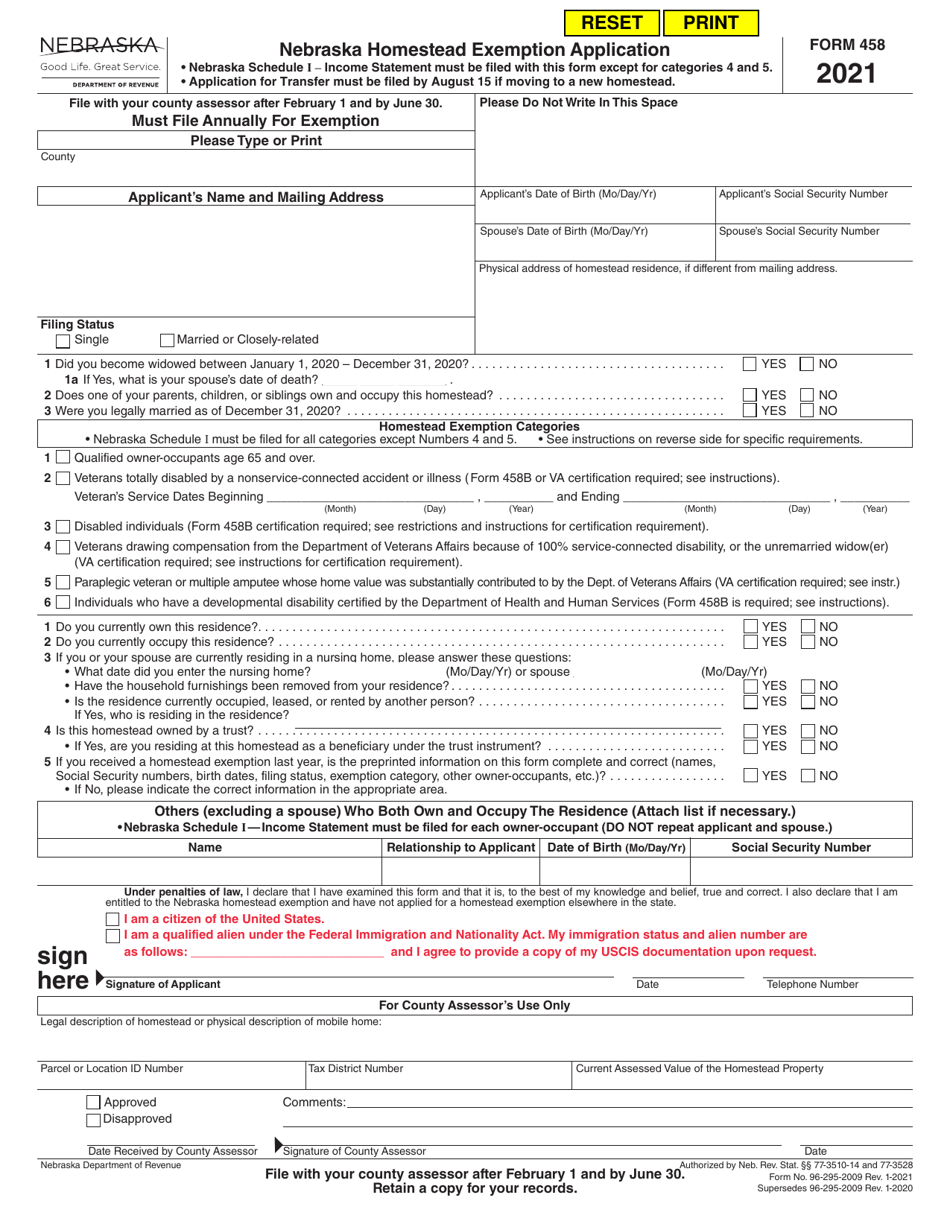

Form 458S Fill Out, Sign Online and Download Fillable PDF, Nebraska

Nebraska to require more online retailers collect sales tax Nebraska

Form 458 Download Fillable PDF or Fill Online Nebraska Homestead

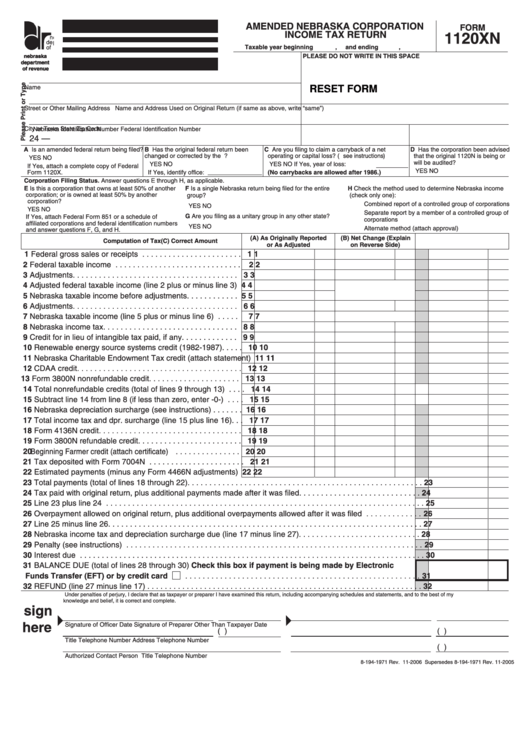

Fillable Form 1120xn Amended Nebraska Corporation Tax Return

Form 13 Download Fillable PDF or Fill Online Nebraska Resale or Exempt

Audit Support Guaranteeeasy And Accurate

Web Nebraska Sales Tax Exemptions Chart.

You Can Use Our Nebraska Sales Tax Calculator To.

Web We Last Updated The Nebraska Resale Or Exempt Sale Certificate For Sales Tax.

Related Post: