Save Plan Chart

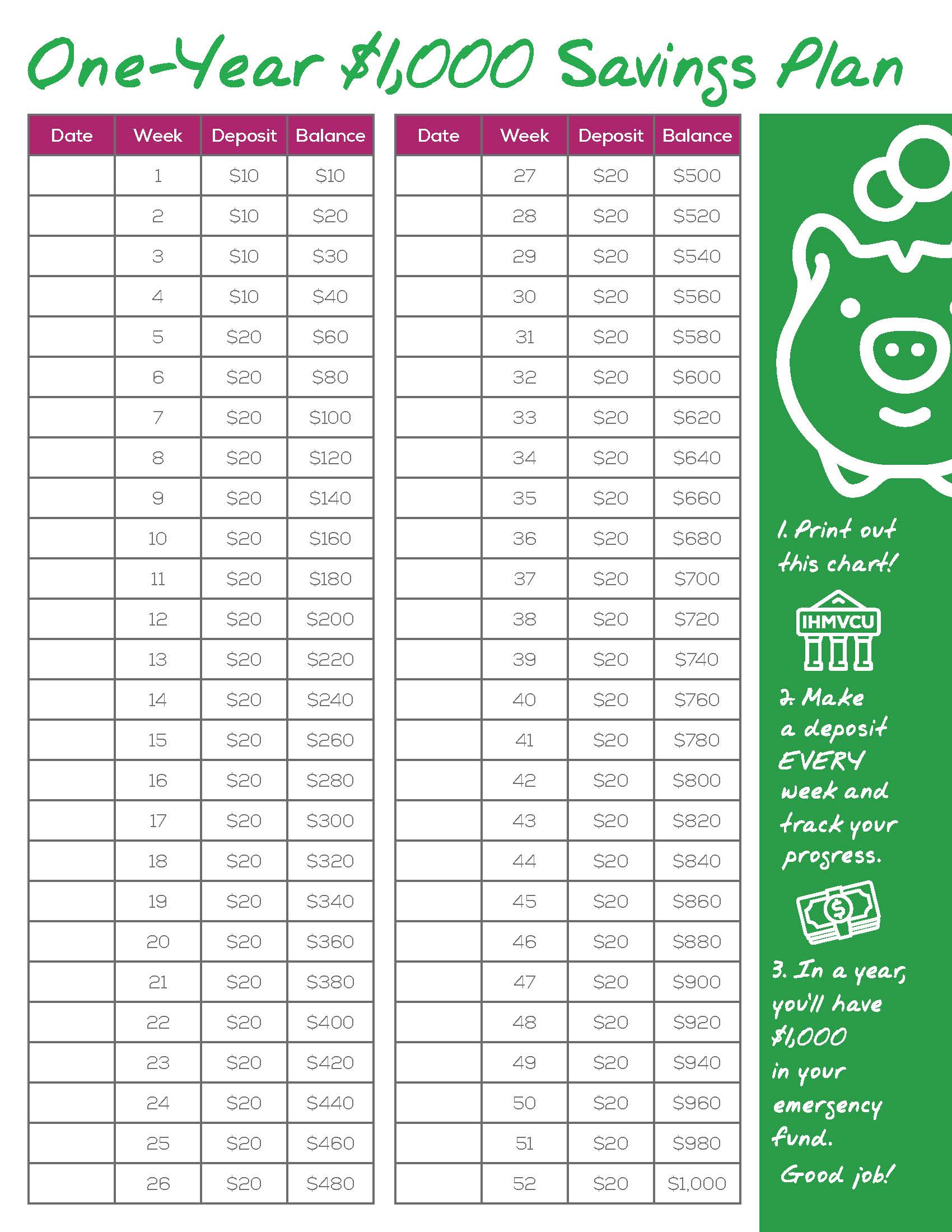

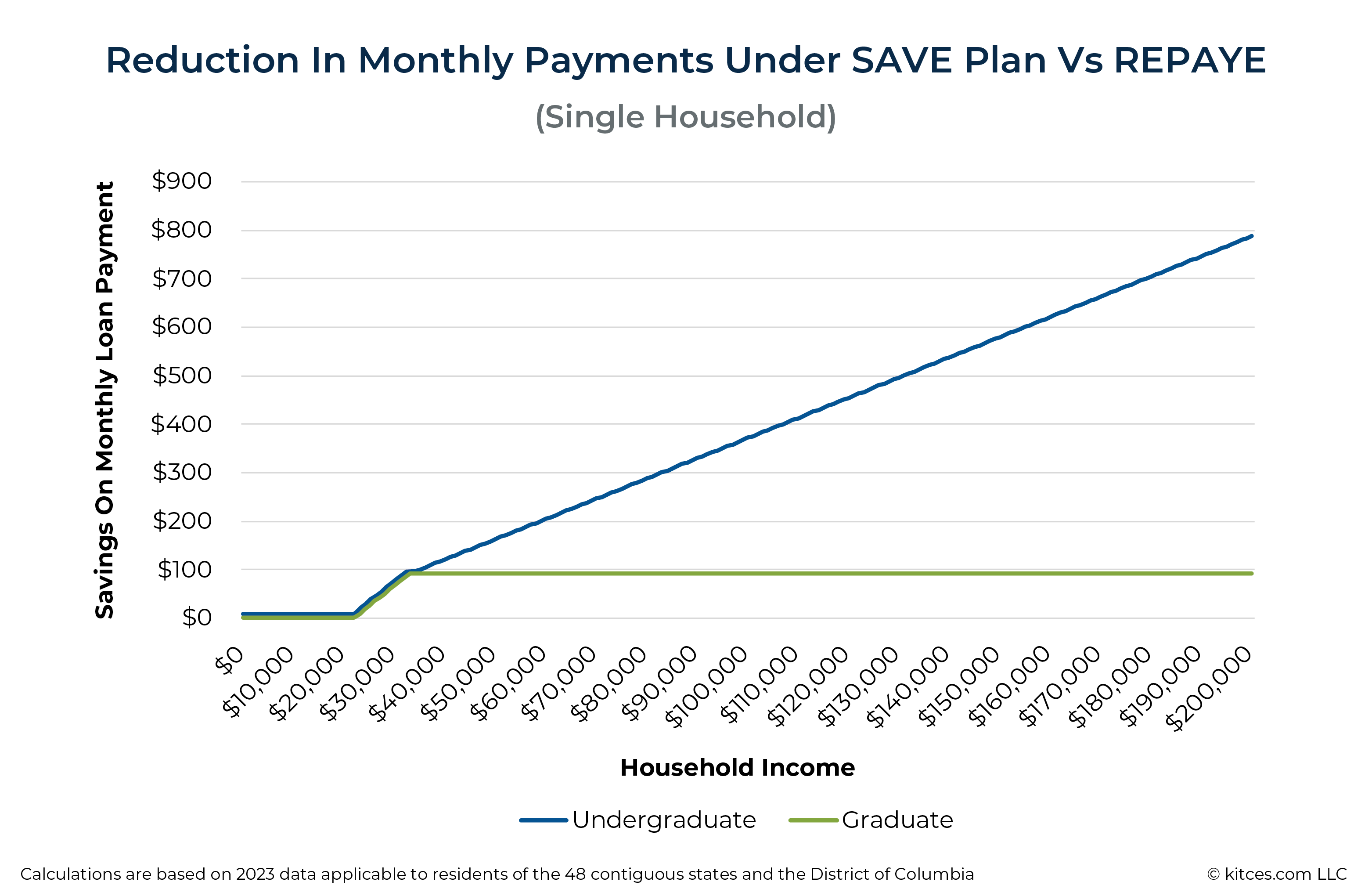

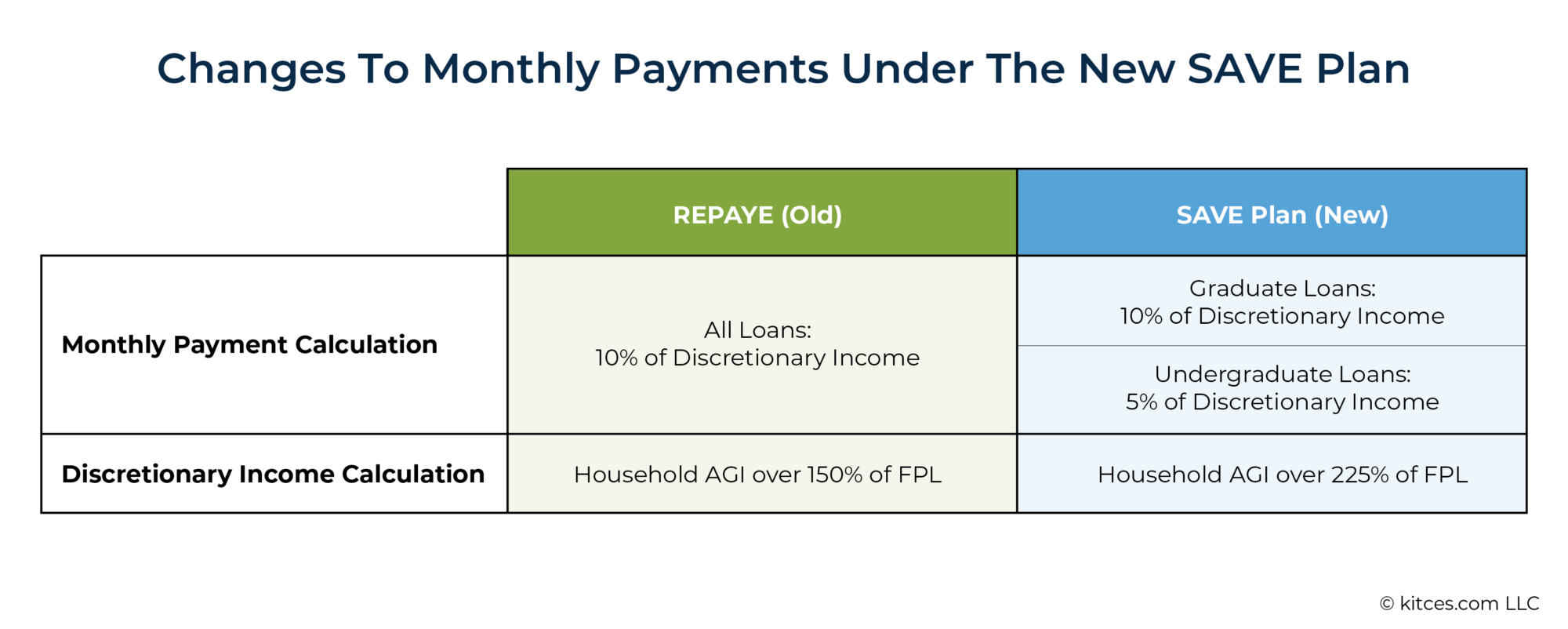

Save Plan Chart - Web a medicare program for people with limited income and resources that helps lower medicare drug plan costs (like premiums, deductibles, and coinsurance). 5.1 how big should your emergency fund be? You’ll pay no more than $11.20 in 2024 for each drug covered by your medicare drug plan. Web the discretionary income calculator above is completely updated using the latest 2023 poverty guidelines that the government publishes every january. By the time you reach your first $155 week, you’ll be 10 weeks into the challenge. What is your family size? The new save plan (which is replacing the revised pay as you. Web your monthly payment is based on your discretionary income — the difference between your adjusted gross income and 225% of the poverty line for your family size, up from the 150% guideline used in. For example, in week one, you save $1, week two, you save $2, week three, you save $3, and so on until you get to. Servicers use the federal poverty line to calculate how much income you actually need to pay a percentage of under income driven repayment (idr) plans. Apply for the save plan at studentaid.gov. Web under the saving on a valuable education (save) plan, a single borrower who makes less than $15 an hour will not have to make any payments.1 borrowers earning above that amount would save more than $1,000 a year on their. Servicers use the federal poverty line to calculate how much income you. Web do you want to save money and plan ahead for your education expenses? Web 2 savings excel template. Don’t be discouraged — this is totally doable, even if it sounds like a long shot! What is your family size? Web deposit $25 into your savings account on week 5. Apply for the save plan at studentaid.gov. Web 2 savings excel template. (including unborn children) list the smaller of your prior year agi or your current income. You’ll pay no more than $11.20 in 2024 for each drug covered by your medicare drug plan. Web a medicare program for people with limited income and resources that helps lower medicare drug. Web the save plan calculates your monthly payment amount based on your income and family size. The chart allows for financial ups and downs which are part of just about everyone’s life. There are different repayment options to research before choosing the save plan. You can also find out how to apply for grants, loans, and scholarships from the federal. Web if you earn $60,000 or less, see the chart below for your estimated monthly payment based on your income and family size. Visit federal student aid's website and learn how to create a budget, compare costs, and explore different ways to pay for college or career school. Web the save plan calculates your monthly payment amount based on your. Web 2 savings excel template. Web this chart guarantees that you’ll save $1000 in 52 weeks if you set aside every amount outlined in each box. There are different repayment options to research before choosing the save plan. This calculator estimates both numbers. It replaced the revised pay as you earn (repaye) plan and may offer the most affordable monthly. If you have a $0. Show both your medicare card and medicaid card (or qmb card). Use cnn’s calculator to see how much your. The new save plan (which is replacing the revised pay as you. Web the save plan provides the lowest monthly payments of any idr plan available to most borrowers. 5 creating an emergency fund. Web your monthly payment is based on your discretionary income — the difference between your adjusted gross income and 225% of the poverty line for your family size, up from the 150% guideline used in. Use cnn’s calculator to see how much your. You can also find out how to apply for grants, loans, and. Web deposit $25 into your savings account on week 5. This calculator estimates both numbers. What is your family size? Web another benefit introduced by the save plan is the reduction of time to forgiveness for borrowers who have taken out smaller loans to pay for college. By the time you reach your first $155 week, you’ll be 10 weeks. By the time you reach your first $155 week, you’ll be 10 weeks into the challenge. The chart allows for financial ups and downs which are part of just about everyone’s life. Web this chart guarantees that you’ll save $1000 in 52 weeks if you set aside every amount outlined in each box. The biden administration has touted the new. This is one of the easiest charts to follow because you start with $1 the first week and add an extra dollar each week. Web another benefit introduced by the save plan is the reduction of time to forgiveness for borrowers who have taken out smaller loans to pay for college. If you have a $0. For example, anyone making $32,800 a year or less will have a monthly payment of $0. Web the save plan provides the lowest monthly payments of any idr plan available to most borrowers. Web a new federal student loan repayment plan known as save (saving on a valuable education) could lower monthly payments for millions of borrowers. By enrolling in the save plan now, you will. The new save plan is getting phased in, meaning payments in october will be slightly different than payments next july. By the time you reach your first $155 week, you’ll be 10 weeks into the challenge. The chart allows for financial ups and downs which are part of just about everyone’s life. Use cnn’s calculator to see how much your. At the end of five weeks, you’ll have $75 in your savings account. Web your monthly payment is based on your discretionary income — the difference between your adjusted gross income and 225% of the poverty line for your family size, up from the 150% guideline used in. Show both your medicare card and medicaid card (or qmb card). Estimated monthly payments for student borrowers using the new save. Don’t be discouraged — this is totally doable, even if it sounds like a long shot!

One year, One Thousand Dollar Savings Plan

SAVE PLan Eng White House Initiative on Advancing Educational Equity

Print Off This Checklist & Save 100 This Month Saving money diy

How to Save 5000 in 26 Weeks A Simple Biweekly Savings Plan Money

Save Up 10,000 This Year With This Chart Real Estate Finance

How The New SAVE Plan Impacts Student Loan Planning

52 Week Savings Plan Printable

3 New 52 Week Savings Plan Ideas 4 Hats and Frugal

How The New SAVE Plan Impacts Student Loan Planning

52 Week Saving Plan, Weekly Saving, 52 Week Savings, Savings Plan, Free

Web The Discretionary Income Calculator Above Is Completely Updated Using The Latest 2023 Poverty Guidelines That The Government Publishes Every January.

Produced By Michael Simon Johnson And Carlos Prieto.

Web Under The Saving On A Valuable Education (Save) Plan, A Single Borrower Who Makes Less Than $15 An Hour Will Not Have To Make Any Payments.1 Borrowers Earning Above That Amount Would Save More Than $1,000 A Year On Their.

Visit Federal Student Aid's Website And Learn How To Create A Budget, Compare Costs, And Explore Different Ways To Pay For College Or Career School.

Related Post: