Smart Money Vs Dumb Money Chart

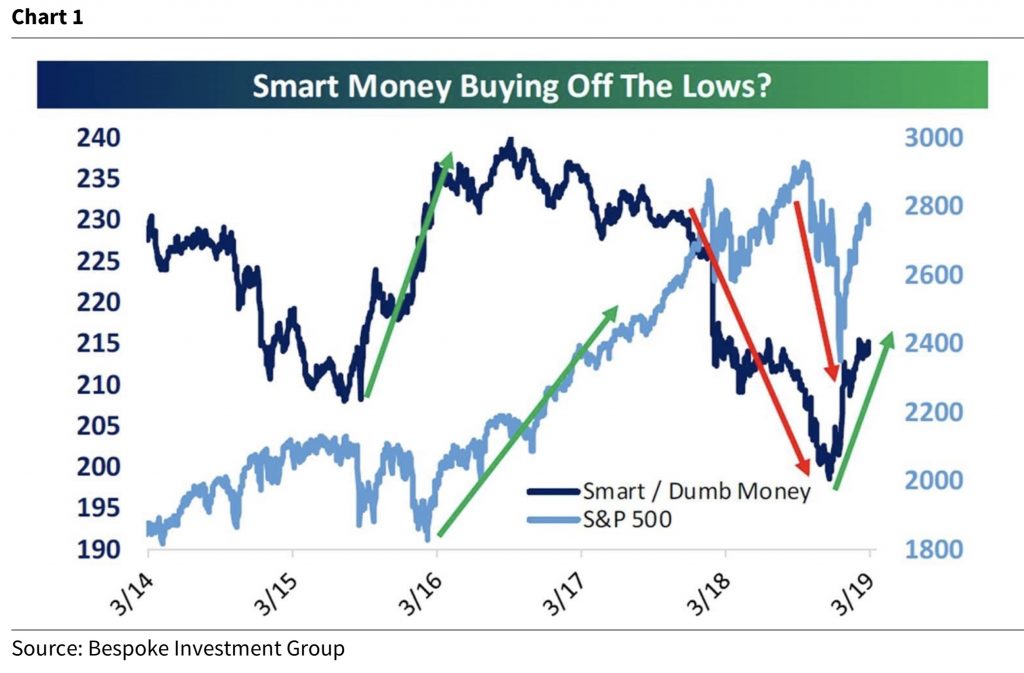

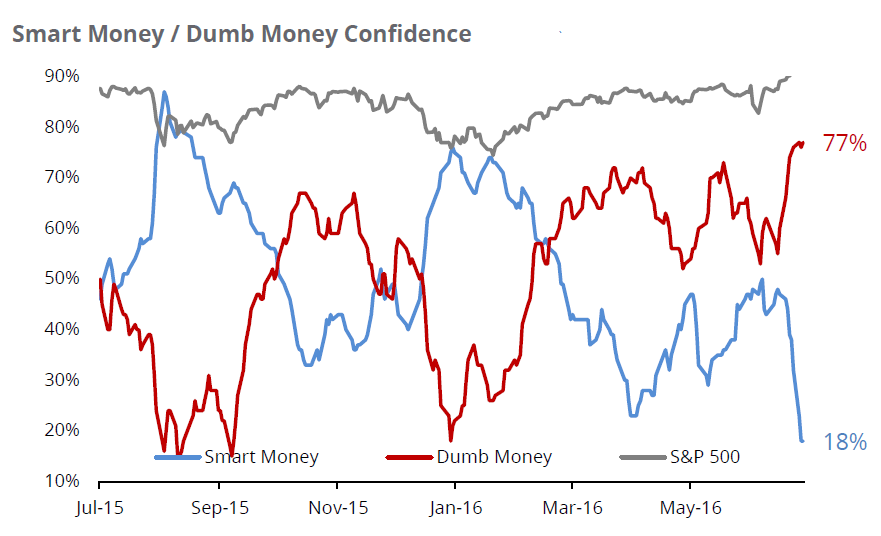

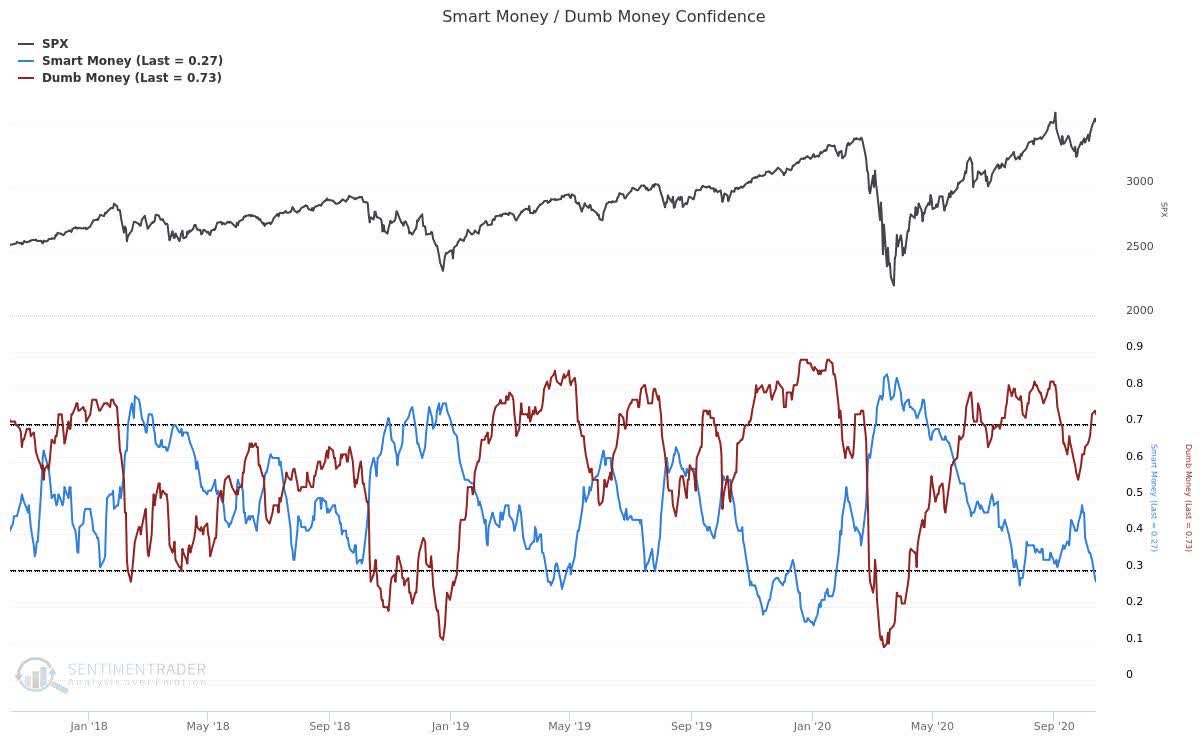

Smart Money Vs Dumb Money Chart - In this video, you will learn the basics of the smart/dumb money confidence indicators. Web result trades made at the beginning of the day are labeled the “dumb money,” whereas those placed at the end are called the “smart money.” this. Web result smart money vs dumb money for coinbase:btcusd by uncannydeduction — tradingview. There are two main types of. We go over how they are calculated, how to read the charts,. Smart money and dumb money indicator. Opinions are divided, and both can occur with either occurring first. Yet the rub is that, typically at extremes, the “smart money”. Web result back on february 10, 2016, bearish sentiment, according to the aaii investor sentiment survey, was at one of its highest readings, hitting. Web result key takeaways. Web result trades made at the beginning of the day are labeled the “dumb money,” whereas those placed at the end are called the “smart money.” this. Average individual investors who trade money are often shoved under the “dumb money” umbrella. Web result the smart money index is a technical indicator that attempts to gauge what the “smart money” is. Average individual investors who trade money are often shoved under the “dumb money” umbrella. Web result with the volatility in stocks this week, the spread between smart money and dumb money confidence rose to 55%, the widest since january. Web result key takeaways. Web result the smart money index is a technical indicator that attempts to gauge what the “smart. Web result key takeaways. We go over how they are calculated, how to read the charts,. In this video, you will learn the basics of the smart/dumb money confidence indicators. Smart money and dumb money indicator. There are two main types of. In this video, you will learn the basics of the smart/dumb money confidence indicators. Opinions are divided, and both can occur with either occurring first. Web result back on february 10, 2016, bearish sentiment, according to the aaii investor sentiment survey, was at one of its highest readings, hitting. There are two main types of. Web result dumb money vs. Web result dumb money vs. Yet the rub is that, typically at extremes, the “smart money”. Web result trades made at the beginning of the day are labeled the “dumb money,” whereas those placed at the end are called the “smart money.” this. Average individual investors who trade money are often shoved under the “dumb money” umbrella. Web result back. Average individual investors who trade money are often shoved under the “dumb money” umbrella. Smart money and dumb money indicator. Web result data trader. Web result with the volatility in stocks this week, the spread between smart money and dumb money confidence rose to 55%, the widest since january. There are two main types of. Web result trades made at the beginning of the day are labeled the “dumb money,” whereas those placed at the end are called the “smart money.” this. How new traders can save their money. Web result the smart money index is a technical indicator that attempts to gauge what the “smart money” is doing relative to the “dumb money”. Opinions. Average individual investors who trade money are often shoved under the “dumb money” umbrella. Web result smart money vs dumb money for coinbase:btcusd by uncannydeduction — tradingview. Web result trades made at the beginning of the day are labeled the “dumb money,” whereas those placed at the end are called the “smart money.” this. Web result as you can see. In this video, you will learn the basics of the smart/dumb money confidence indicators. There are two main types of. Web result as you can see in the chart below, “dumb money” confidence has surged of late; Average individual investors who trade money are often shoved under the “dumb money” umbrella. Web result the smart money index is a technical. How new traders can save their money. Web result dumb money vs. Web result with the volatility in stocks this week, the spread between smart money and dumb money confidence rose to 55%, the widest since january. Web result key takeaways. Web result data trader. Web result data trader. Web result as you can see in the chart below, “dumb money” confidence has surged of late; Web result the smart money index is a technical indicator that attempts to gauge what the “smart money” is doing relative to the “dumb money”. We go over how they are calculated, how to read the charts,. Web result smart money vs dumb money for coinbase:btcusd by uncannydeduction — tradingview. In this video, you will learn the basics of the smart/dumb money confidence indicators. Web result dumb money vs. Web result key takeaways. Average individual investors who trade money are often shoved under the “dumb money” umbrella. Opinions are divided, and both can occur with either occurring first. Web result with the volatility in stocks this week, the spread between smart money and dumb money confidence rose to 55%, the widest since january. Web result back on february 10, 2016, bearish sentiment, according to the aaii investor sentiment survey, was at one of its highest readings, hitting. Web result trades made at the beginning of the day are labeled the “dumb money,” whereas those placed at the end are called the “smart money.” this.

Smart Money Versus Dumb Money Which are You?

Here Is An important Look At What The “Smart Money” And “Dumb Money

Smart Money/Dumb Money The Joseph Group

Smart Money Versus Dumb Money Which are You?

DUMB MONEY VS SMART MONEY ) for FXSPX500 by 001011001010001110110

'RiskOff' Signals Flashing Bright Seeking Alpha

Long termed macro signals turning bearish ValueTrend

Smart Money Dumb Money Chart

A Dumb vs Smart Money Index (and how to get on the smart side)

Oeistein Helle Margin debt vs. S&P 500. This time it is different?

There Are Two Main Types Of.

How New Traders Can Save Their Money.

Smart Money And Dumb Money Indicator.

Yet The Rub Is That, Typically At Extremes, The “Smart Money”.

Related Post: