Triple Top Chart Pattern

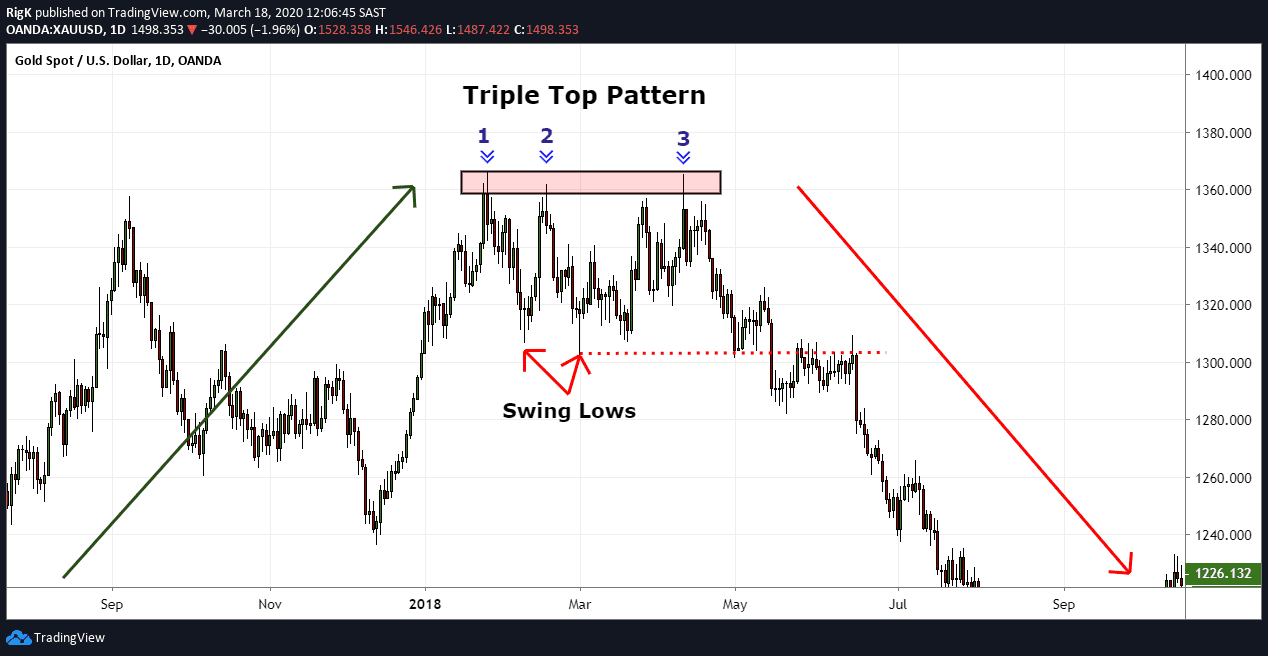

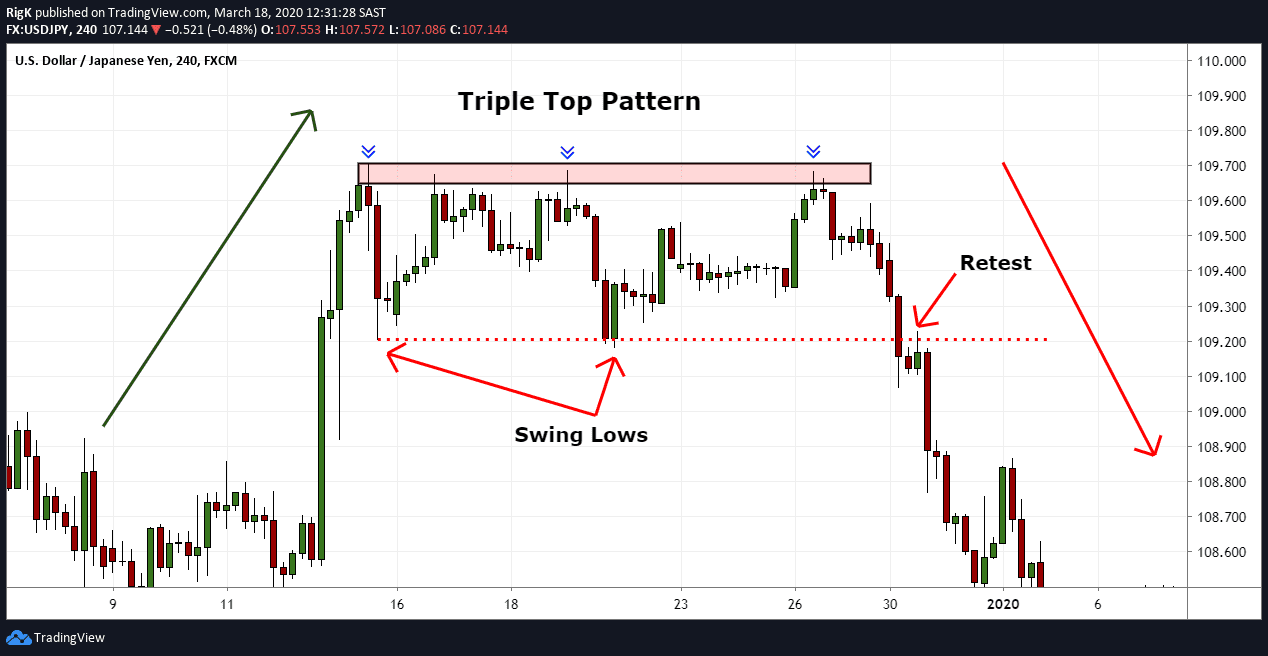

Triple Top Chart Pattern - In this complete guide to the triple top pattern, you’ll learn the common interpretation of the pattern, as well as how you may go about to improve its performance. Web the triple top reversal is a bearish reversal pattern typically found on bar charts, line charts and candlestick charts. Whereas triple bottom is a bullish chart reversal pattern that leads to the trend change to the upside. Upon completion, it resembles the shape of the letter m. One of the main benefits of a reversal trading strategy is that it gives you the opportunity to be part of a new trend right from the beginning. The triple top pattern consists of three similar price highs with price pullbacks between the peaks. There are three equal highs followed by a break below support. The triple top pattern is quite a straightforward formation. Note that a triple top reversal on a bar or line chart is completely different. Thus, it’s commonly interpreted as a sign of a coming bearish trend. Web the triple top chart pattern trading strategy is a reversal strategy that seeks to take advantage of a simple yet very powerful chart pattern. They are extensions of the double top and double bottom chart patterns. An overall positive/upwards price movement. Here’s how it looks like…. For the triple top below, the resistance zone causes a correction 3 times. Consisting of three peaks, a triple top signals that the. Web a triple top is a bearish reversal chart pattern that signals the sellers are in control (the opposite is called a triple bottom pattern). Whereas triple bottom is a bullish chart reversal pattern that leads to the trend change to the upside. An overall positive/upwards price movement. Web a. It consists of three consecutive highs/tops recorded at, or near, the same level. Three peaks follow one another, showing significant resistance. The triple top pattern is quite a straightforward formation. Whereas triple bottom is a bullish chart reversal pattern that leads to the trend change to the upside. Web the triple top pattern is a bearish reversal chart pattern that. Buyers are in control as the price makes a. A type of chart that displays an asset’s opening, closing, and high and low prices for a predetermined period. Thus, it’s commonly interpreted as a sign of a coming bearish trend. Web a triple top pattern, also called a triple top reversal, is a charting pattern used in technical analysis that. It consists of three consecutive highs/tops recorded at, or near, the same level. Thus, it’s commonly interpreted as a sign of a coming bearish trend. Three peaks follow one another, showing significant resistance. In this complete guide to the triple top pattern, you’ll learn the common interpretation of the pattern, as well as how you may go about to improve. Web the triple top chart pattern trading strategy is a reversal strategy that seeks to take advantage of a simple yet very powerful chart pattern. It consists of three consecutive highs/tops recorded at, or near, the same level. Consisting of three peaks, a triple top signals that the. Web a triple top is formed by three peaks moving into the. Web the triple top chart pattern trading strategy is a reversal strategy that seeks to take advantage of a simple yet very powerful chart pattern. Thus, it’s commonly interpreted as a sign of a coming bearish trend. A market characterized by falling/downward price movement. They are extensions of the double top and double bottom chart patterns. Consisting of three peaks,. Web what the pattern tells us. Three peaks follow one another, showing significant resistance. Web triple top is a bearish reversal chart pattern that leads to the trend change to the downside. Here’s how it looks like…. Upon completion, it resembles the shape of the letter m. They are extensions of the double top and double bottom chart patterns. Upon completion, it resembles the shape of the letter m. For the triple top below, the resistance zone causes a correction 3 times. Buyers are in control as the price makes a. Web the triple top is a type of chart pattern used in technical analysis to predict. Web as the name suggests, a triple top is a bearish technical analysis chart pattern that occurs after an uptrend and tests the highest price three times before it starts a bearish downward movement. An overall positive/upwards price movement. Buyers are in control as the price makes a. Upon completion, it resembles the shape of the letter m. The triple. Web a triple top is formed by three peaks moving into the same area, with pullbacks in between, while a triple bottom consists of three troughs with rallies in the middle. For the triple top below, the resistance zone causes a correction 3 times. An overall positive/upwards price movement. There are three equal highs followed by a break below support. Web a triple top pattern, also called a triple top reversal, is a charting pattern used in technical analysis that signals a potential reversal. Web the triple top pattern is a bearish reversal chart pattern that emerges after a prolonged uptrend, signaling that the market may be about to turn bearish. Web triple top is a bearish reversal chart pattern that leads to the trend change to the downside. After the price hits the third peak and falls below the neckline, the asset’s price is expected to continue falling and a trend reversal occurs. For this chart pattern to take place in the first place, the price action has to trade in a clear uptrend. They are extensions of the double top and double bottom chart patterns. Web a triple top is a bearish reversal chart pattern that signals the sellers are in control (the opposite is called a triple bottom pattern). A market characterized by falling/downward price movement. Web as the name suggests, a triple top is a bearish technical analysis chart pattern that occurs after an uptrend and tests the highest price three times before it starts a bearish downward movement. Buyers are in control as the price makes a. This pattern consists of three peaks or tops, following a bullish trend, indicating that the market lacks the strength to break through the previous highs. Consisting of three peaks, a triple top signals that the.

The Monster Guide To Triple Top Trading Pattern Pro Trading School

What Are Triple Top and Bottom Patterns in Crypto Trading? Bybit Learn

:max_bytes(150000):strip_icc()/dotdash_Final_Triple_Top_Dec_2020-01-78a37beca8574d169c2cccd1fc18279d.jpg)

casual desconocido he equivocado tops stock buy or sell Delgado

Chart Pattern Triple Top — TradingView

Triple Top Pattern A Guide by Experienced Traders

Triple Top Pattern Explained Stock Chart Patterns

The Complete Guide to Triple Top Chart Pattern

Triple Top Pattern A Technical Analyst's Guide ForexBee

The Complete Guide to Triple Top Chart Pattern

Triple Top Pattern A Guide by Experienced Traders

Whereas Triple Bottom Is A Bullish Chart Reversal Pattern That Leads To The Trend Change To The Upside.

Three Peaks Follow One Another, Showing Significant Resistance.

Web A Triple Top Is A Bearish Reversal Chart Pattern That Signals That Buyers Are Losing Control To The Sellers.

Web A Triple Top Chart Pattern Is A Bearish Candlestick Pattern That Occurs At The End Of An Uptrend.

Related Post: