W Chart Pattern

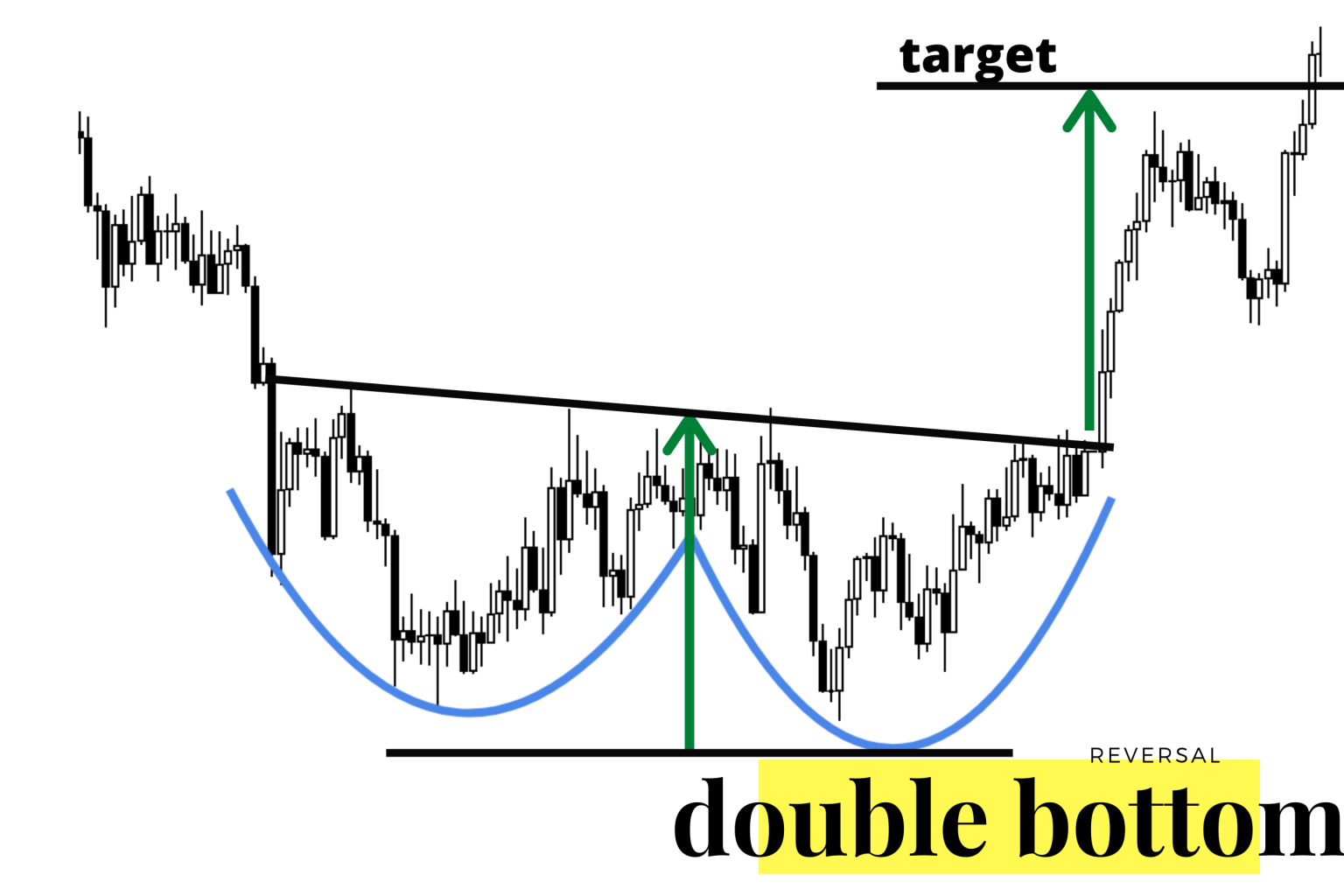

W Chart Pattern - Web the w chart pattern is a reversal chart pattern that signals a potential change from a bearish trend to a bullish trend. The double bottom pattern looks like the letter w. the. Web the “w” pattern is indicative of a corrective or reversal move. Recognizing the formation of bottoms and tops in w pattern. Web how to identify the w pattern shape or formation. It is considered a continuation pattern, indicating that the prevailing trend is likely to continue after a brief consolidation or pause. Web updated with new statistics on 8/25/2020. It resembles the letter “w”. Once price completes the handle, the rise resumes. The difference between w pattern and other chart patterns. This pattern gets its name because it looks like a w when viewed on a chart. How to spot a double bottom pattern in a w pattern chart. Web the structure of w pattern: Price often confirms the double bottom and approaches the height of the left side trend start before retracing and forming a handle. It is formed by. A big w is a double bottom with tall sides. Web a double bottom pattern is a classic technical analysis charting formation showing a major change in trend from a prior down move. Therefore, when a “w” renko chart pattern is spotted, we always take a short position as described below. Web updated with new statistics on 8/25/2020. When the. Importance of w pattern chart in trading strategies. Web the “w” pattern is indicative of a corrective or reversal move. Understanding double tops and bottoms double top and bottom patterns typically evolve over a longer period of time,. You can’t have large price moves without sufficient volume. Web the structure of w pattern: This pattern gets its name because it looks like a w when viewed on a chart. Initial drop in price, establishing the first bottom. Importance of w pattern chart in trading strategies. The w pattern is a. Important results identification guidelines trading tips example other. Price often confirms the double bottom and approaches the height of the left side trend start before retracing and forming a handle. Initial drop in price, establishing the first bottom. A big w is a double bottom with tall sides. Web the w pattern is a chart formation that appears as two consecutive lows separated by a peak. Web a. Web the w chart pattern is a reversal chart pattern that signals a potential change from a bearish trend to a bullish trend. Once price completes the handle, the rise resumes. Web a flag pattern is a technical analysis chart pattern that can be observed in the price charts of financial assets, such as stocks, currencies, or commodities. Web the. This pattern indicates that the asset has faced support twice at a similar level and may be due for a reversal in trend. Web the structure of w pattern: Identifying double bottoms and reversals. You can’t have large price moves without sufficient volume. Web a flag pattern is a technical analysis chart pattern that can be observed in the price. This pattern indicates that the asset has faced support twice at a similar level and may be due for a reversal in trend. Important results identification guidelines trading tips example other. Web w pattern (double bottom pattern) trading with double top trading with double bottom summary of important points in the double bottom and double top patterns it would help. Important results identification guidelines trading tips example other. Web the w pattern is a chart formation that appears as two consecutive lows separated by a peak. The w pattern is a. It is considered a continuation pattern, indicating that the prevailing trend is likely to continue after a brief consolidation or pause. Seeing might not always be believing in stock. The w pattern is a. The difference between w pattern and other chart patterns. Web w pattern (double bottom pattern) trading with double top trading with double bottom summary of important points in the double bottom and double top patterns it would help if you clearly understood the reason behind the application of w and m pattern trading, even though. Web the structure of w pattern: The double bottom pattern looks like the letter w. the. Web a double bottom pattern is a classic technical analysis charting formation showing a major change in trend from a prior down move. It is formed by drawing two downward legs followed by an upward move that retraces a significant portion of the prior decline. Understanding double tops and bottoms double top and bottom patterns typically evolve over a longer period of time,. Web a flag pattern is a technical analysis chart pattern that can be observed in the price charts of financial assets, such as stocks, currencies, or commodities. It resembles the letter “w”. A big w is a double bottom with tall sides. Therefore, when a “w” renko chart pattern is spotted, we always take a short position as described below. Initial drop in price, establishing the first bottom. Web the w chart pattern is a reversal chart pattern that signals a potential change from a bearish trend to a bullish trend. You can’t have large price moves without sufficient volume. Price often confirms the double bottom and approaches the height of the left side trend start before retracing and forming a handle. Seeing might not always be believing in stock trading, but the w pattern tends to stick out once you. Once price completes the handle, the rise resumes. Web updated with new statistics on 8/25/2020.

The M and W Pattern YouTube

W pattern forex

W Bottom and M Tops Forex, Pattern, Transcription

Learn How to Trade and Profit from Chart Pattern Failures Forex

W Pattern Trading YouTube

Wpattern — TradingView

W Pattern Trading New Trader U

How to Trade Double Bottom Pattern A StepByStep Guide Trade

W Pattern Trading The Forex Geek

The Easiest Forex Trading Strategy You’ll Find Smart Forex Learning

Importance Of W Pattern Chart In Trading Strategies.

Web The “W” Pattern Is Indicative Of A Corrective Or Reversal Move.

It Is Considered A Continuation Pattern, Indicating That The Prevailing Trend Is Likely To Continue After A Brief Consolidation Or Pause.

Web How To Identify The W Pattern Shape Or Formation.

Related Post: