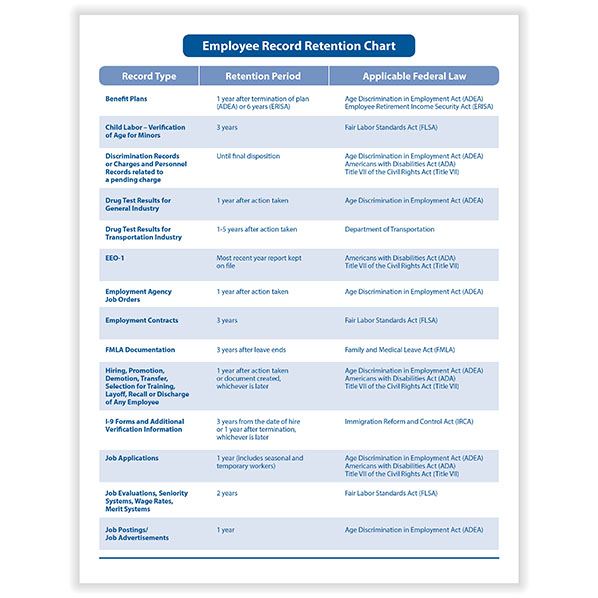

Employee Record Retention Chart

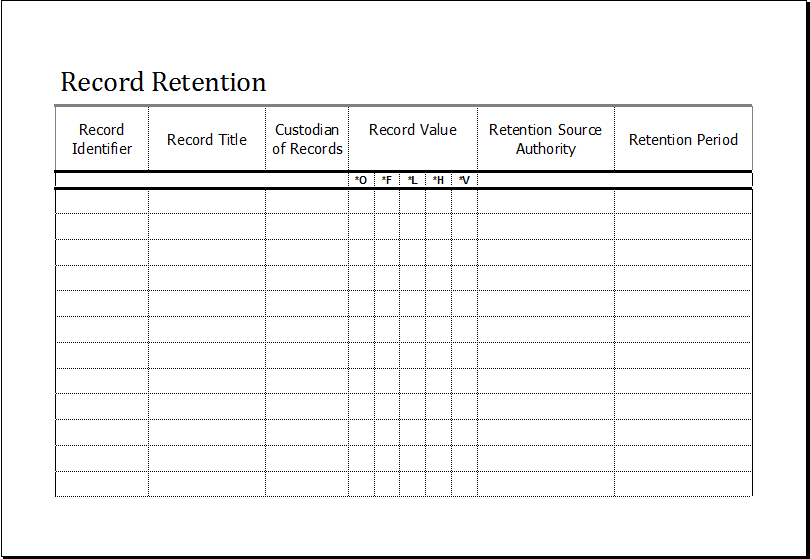

Employee Record Retention Chart - Employment act of 1967 (adea) payroll or other records for each employee that contain: Records on the general administration and operation of human resource management programs and functions; Web employee record retention requirements. Compensation earned each week termination + three (3) years. Federal labor laws by number of employees. Be sure to abide by them all with the help of this employee record retention chart. Web nowadays there are numerous recordkeeping laws for employers to adhere to. The equal employment opportunity commission (eeoc) outlines basic requirements for recordkeeping. Please note that state requirements may require record retention for longer periods than the federal requirement and should be reviewed to determine your responsibility. Documents should be kept in a secure facility, document management system (dms), or in cloud storage with restricted access to respect employee data privacy. Individual states also have requirements not. As well as records that concern individual. Understanding the legal requirements for storing employee related data. Some of the requirements apply to most or all employers while others apply to government contractors and subcontractors. Federal contractors are required to retain records for longer periods than posted below.) record type and explanation. Web shrm has a chart on federal record retention requirements to assist in identifying statutory requirements. Web a records retention schedule ensures that an organization keeps the records it needs for operational, legal, fiscal or historical reasons, and then destroys them when they’re no longer useful. Web used in the personnel management or personnel policy setting process. Please note that. Web nowadays there are numerous recordkeeping laws for employers to adhere to. Please note that state requirements may require record retention for longer periods than the federal requirement and should be reviewed to determine your responsibility. These include records that relate to the supervision over, and management of, federal civilian employees; Records on the general administration and operation of human. Web shrm has a chart on federal record retention requirements to assist in identifying statutory requirements. Some of the requirements apply to most or all employers while others apply to government contractors and subcontractors. Understanding the legal requirements for storing employee related data. This informational chart breaks down current recordkeeping standards by record type, retention period, and applicable federal law.. Federal contractors are required to retain records for longer periods than posted below.) record type and explanation. Employers should review the laws to determine specific coverage and responsibilities. As well as records that concern individual. What is a record retention policy? California and federal law identify minimum requirements for keeping records, but some records should be kept longer. California and federal law identify minimum requirements for keeping records, but some records should be kept longer. Some of the requirements apply to most or all employers while others apply to government contractors and subcontractors. Federal labor laws by number of employees. Benefit plan disclosure & requirements. What is the retention period for employee information? It requires businesses to retain personnel and employment records for “one year from the date of. See a chart of federal record. Federal labor laws by number of employees. Web “hr should have at hand and periodically update a chart for each type of record to be retained, the primary custodian, the retention period, and the law or regulation that. Web who is responsible for managing employee records? Web employers should work with their legal counsel to determine the recommended retention rules for their organization, including any specific state requirements. Here is a list of records with the minimum time they should be kept, and, in some cases, recommendations for keeping those records longer. Be sure to abide by them. Federal contractors are required to retain records for longer periods than posted below.) record type and explanation. Employment act of 1967 (adea) payroll or other records for each employee that contain: Web employers should work with their legal counsel to determine the recommended retention rules for their organization, including any specific state requirements. Some of the requirements apply to most. Individual states also have requirements not. Understanding the legal requirements for storing employee related data. Please note that state requirements may require record retention for longer periods than the federal requirement and should be reviewed to determine your responsibility. Retention periods range from one year for drug test results to 30 years for hazardous exposure. Employers must maintain certain employment. Here is a list of records with the minimum time they should be kept, and, in some cases, recommendations for keeping those records longer. Please be aware that the content provided in this article is for informational purposes only and should not be considered as legal advice. Web “hr should have at hand and periodically update a chart for each type of record to be retained, the primary custodian, the retention period, and the law or regulation that governs how long to. Individual states also have requirements not. Federal contractors are required to retain records for longer periods than posted below.) record type and explanation. Web shrm has a chart on federal record retention requirements to assist in identifying statutory requirements. These include records that relate to the supervision over, and management of, federal civilian employees; Be sure to abide by them all with the help of this employee record retention chart. You may base your records retention schedule on your own experience and research of legal mandates or on what other companies are doing. Benefit plan disclosure & requirements. The equal employment opportunity commission (eeoc) outlines basic requirements for recordkeeping. Web employers should work with their legal counsel to determine the recommended retention rules for their organization, including any specific state requirements. Employee record retention is a core function of hr. Employment act of 1967 (adea) payroll or other records for each employee that contain: All personnel records, including job applications, California and federal law identify minimum requirements for keeping records, but some records should be kept longer.

Record Retention Schedule Templates 11+ Free Docs, Xlsx & PDF

Gantt Chart Sample Competence (Human Resources) Employee Retention

Employee Record Keeping Forms Fresh Staff Holiday Booking System Annual

MS Excel Statement Editable Printable Template Excel Templates

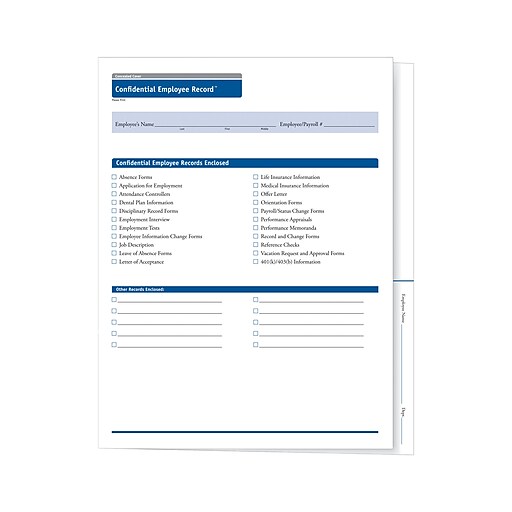

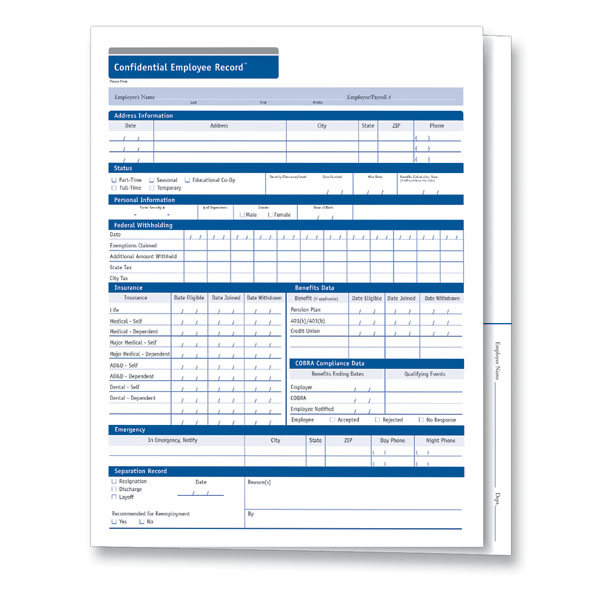

Confidential Employee Record Folder for Important Information

Employee Record Templates 32 Free Word Pdf Documents

Record Retention Guidelines Banks Employment

Records Retention 101

Employee Record Retention Chart 8.5x11 HRdirect

ComplyRight Concealed Cover Confidential Employee Record Folder, Pack

Federal Labor Laws By Number Of Employees.

Documents Should Be Kept In A Secure Facility, Document Management System (Dms), Or In Cloud Storage With Restricted Access To Respect Employee Data Privacy.

Many Employers Now Use Electronic Recordkeeping To Save Space, Eliminate.

Web Who Is Responsible For Managing Employee Records?

Related Post: